The short-term rental market has blossomed into a significant part of the tourism industry, offering travellers unique and often more homely alternatives to traditional hotels. From charming countryside cottages to sleek city apartments, these accommodations provide flexibility and diverse experiences for guests.

However, this dynamic market operates within a framework of rules and regulations that are constantly evolving. For hosts, navigating this complex web of local ordinances, US state laws, and platform-specific policies is not just a matter of best practice – it’s essential for sustainable success.

This comprehensive guide aims to demystify the often-intricate world of short term rental compliance, providing you with the knowledge and insights needed to operate your property legally and effectively – while building your reputation as a trustworthy and reliable host. Read on to discover:

- Why understanding short-term rental regulations matters

- How short-term rental regulations work

- How to stay compliant with short-term rental regulations

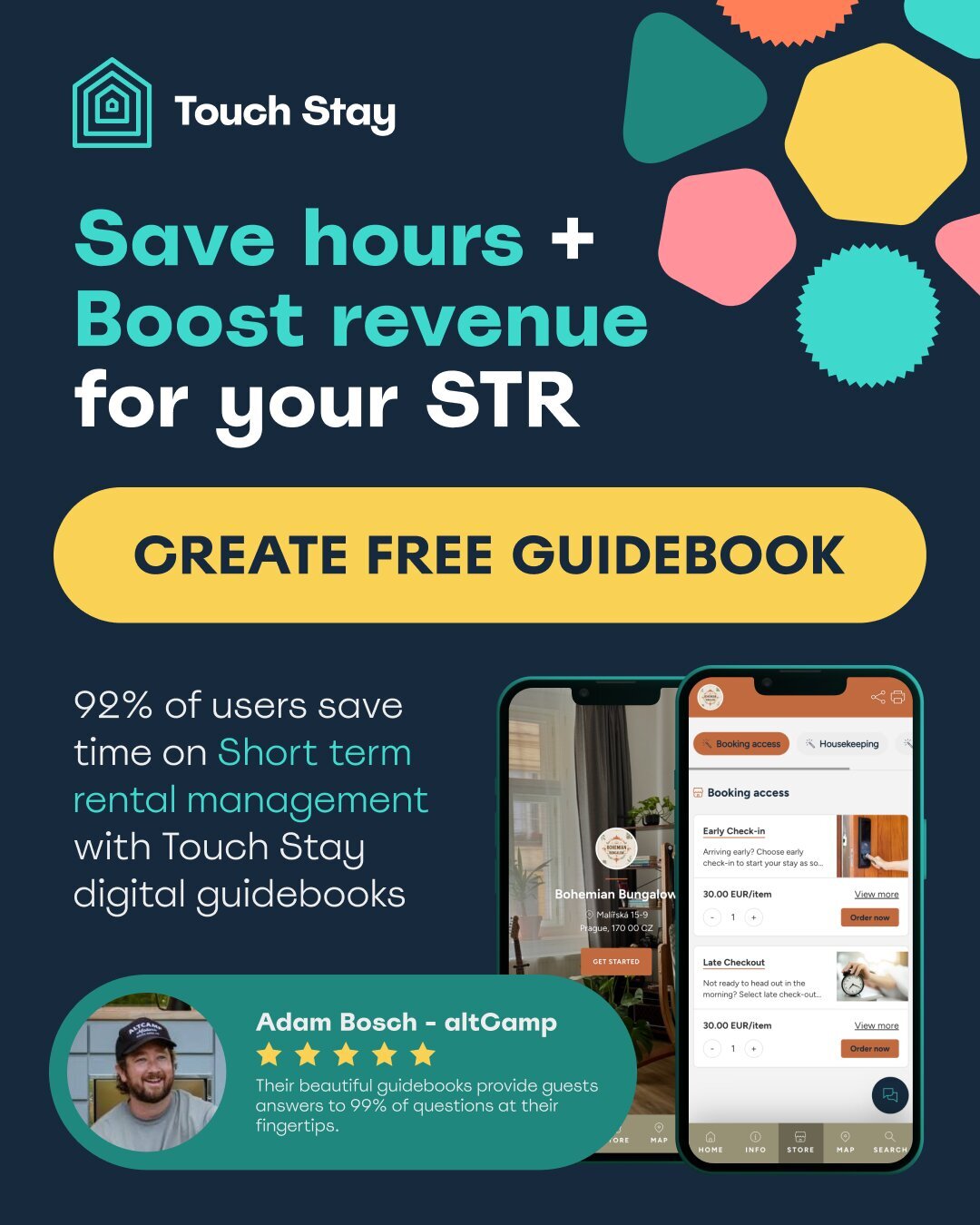

Take the shortcut to Superhost status with a Touch Stay digital guidebook!

Why understanding short-term rental regulations matters

Being a successful short-term rental host goes beyond providing a comfortable bed and a clean space. It requires a thorough understanding of the legal and regulatory environment in which you operate.

Ignoring or neglecting these short term rental rules can have significant repercussions, impacting your profitability and even your ability to continue hosting.

Pro tip: learn everything about Airbnb regulations by state: a comprehensive guide for hosts & investors

Conversely, embracing short term rental compliance offers a multitude of benefits that contribute to a smoother, more successful, and ultimately more rewarding hosting experience. Let's delve into some of the key advantages of staying on the right side of the law.

Avoid costly penalties

One of the most immediate and tangible benefits of understanding and adhering to short term rental regulations is the avoidance of costly penalties.

Local authorities are increasingly cracking down on non-compliant short-term rentals, and the consequences can be severe. These can include:

- Significant fines

- Legal fees

- Court appearances

- Possible suspension or revocation of hosting privileges

Ignorance of the law is rarely considered a valid defence, and the financial burden of non-compliance can quickly erode your profits. By taking the time to understand and implement the necessary short term rental policy, you safeguard your business from these potentially devastating financial and legal risks.

Increase property visibility

In the competitive world of online short-term rental platforms, visibility is key to attracting bookings. Interestingly, platforms like Airbnb and Vrbo often favour listings that demonstrate a commitment to compliance. This can manifest in various ways:

- Higher placement in search results

- Awarding of "verified" or "compliant" badges

Guests are also increasingly discerning, and a listing that clearly demonstrates adherence to local regulations can instil greater confidence and trust. By ensuring your property aligns with all relevant short term rental rules, you enhance your listing's credibility and increase its chances of being seen by potential guests, ultimately leading to more booking enquiries and a higher occupancy rate.

Drive more bookings

Trust is a cornerstone of the short-term rental industry. Guests are entrusting you with their accommodation needs, and they want to feel secure and confident in their choice.

A property that is clearly operating within the bounds of the law signals professionalism and reliability. When your listing explicitly mentions adherence to local short term rental compliance and demonstrates a commitment to safety and transparency (as we'll discuss later), it builds trust with potential guests.

This increased trust translates directly into:

- More bookings

- Positive reviews

Guests are more likely to choose a host who they perceive as responsible and legitimate, contributing to a higher booking volume and a more consistent stream of income.

Maximise your revenue

In the long run, short term rental compliance is not just about avoiding problems; it's about building a sustainable and profitable business. By operating legally and ethically, you minimise disruptions caused by legal challenges or penalties. A compliant property is also more likely to attract:

- Repeat bookings

- Positive word-of-mouth referrals

Both of these are invaluable for long-term revenue generation. Furthermore, by understanding and adhering to tax obligations correctly, you avoid potential audits and ensure you are operating efficiently and within the legal framework, contributing to the long-term financial health and stability of your short-term rental business.

Want to boost your Airbnb revenue? Offer unlimited upsells with a Touch Stay digital guidebook!

How short-term rental regulations work

The specifics of short term rental rules can vary significantly depending on your location, the type of property you are renting, and the platforms you use. However, there are some fundamental areas where regulations commonly apply. Understanding these core areas is the first step towards achieving full short term rental compliance. Let's explore some of the key aspects you need to be aware of.

Licencing and permits

In the US especially, many local and state authorities require short-term rental hosts to obtain specific licences or permits before they can legally operate.

These requirements are put in place to ensure:

- Properties meet certain safety standards

- Hosts are accountable to the local community

The process for obtaining these licences can vary, often involving:

- Registration with the local council or a designated state agency

- Payment of fees

- Potential inspections to ensure your property meets specific criteria

It's crucial to research the specific short term rental policy in your area to understand the necessary licensing and permit requirements and to ensure you have all the correct documentation in place before you start accepting bookings.

- Research local council and state requirements for short-term rental licences and permits.

- Understand the application process, associated fees, and any required inspections.

- Ensure all necessary licences and permits are obtained and kept up-to-date.

Local and state taxes

Short-term rentals in the US are often subject to specific taxes in addition to standard income tax. The most common of these is transient occupancy tax (TOT), also known as hotel tax or tourist tax. This tax is typically:

- Levied on the rental income

- The responsibility of the host to collect from guests

- The responsibility of the host to remit to the relevant tax authorities

The rates and reporting procedures for TOT can vary significantly between jurisdictions. Furthermore, your short-term rental income will also be subject to standard income tax regulations.

- Identify the local and state transient occupancy tax (TOT) rates applicable to your property.

- Understand the procedures for collecting TOT from guests and the deadlines for remitting these funds.

- Ensure you are also aware of your income tax obligations related to your short-term rental income.

Homeowners Associations (HOAs)

If your property is part of a Homeowners Association (HOA), you will also need to consider their rules and regulations regarding short-term rentals. HOAs are private governing bodies that set rules for properties within their jurisdiction, and these rules can sometimes:

- Restrict short-term rentals

- Completely prohibit short-term rentals

It's vital to carefully review your HOA's governing documents, including covenants, conditions, and restrictions (CC&Rs), to understand any limitations or requirements they may impose on short-term letting. Ignoring HOA rules can lead to disputes, fines, and even legal action. Maintaining open communication with your HOA and ensuring your hosting activities align with their short term rental policy is crucial for a harmonious co-existence.

- Review your Homeowners Association (HOA) rules and regulations regarding short-term rentals.

- Understand any restrictions, limitations, or specific requirements imposed by your HOA.

- Maintain open communication with your HOA to ensure your hosting activities are compliant.

Health and safety requirements

Ensuring the health and safety of your guests is paramount, both ethically and legally. Short-term rental properties are typically subject to various health and safety regulations designed to protect occupants. These may include requirements for:

- Working smoke detectors and carbon monoxide detectors

- Clearly marked fire exits

- Adequate insurance coverage

- Adherence to specific cleanliness standards

Pro tip: check out our Airbnb safety guide: 10 tips for safer rentals

Depending on your location, there may also be regulations regarding accessibility, pool safety, and other potential hazards. It's crucial to familiarise yourself with the specific health and safety requirements in your area and to ensure your property meets or exceeds these standards.

- Ensure your property is equipped with working smoke detectors and carbon monoxide detectors.

- Provide clearly marked fire exits and ensure guests are aware of emergency procedures.

- Maintain adequate insurance coverage for your short-term rental business.

- Adhere to high standards of cleanliness and hygiene between guest stays.

Platform-specific rules

In addition to local and state regulations, short-term rental platforms like Airbnb and Vrbo have their own set of rules and guidelines that hosts must adhere to. These platform-specific policies often cover aspects such as:

- Listing accuracy

- Cancellation policies

- Guest communication standards

- Prohibited activities

Pro tip: learn more about understanding Airbnb's cancellation policy options

Failure to comply with these platform rules can result in penalties ranging from listing suspension to permanent removal from the platform. It's essential to thoroughly review and understand the terms of service and hosting guidelines of each platform you use to ensure your listings and hosting practices align with their specific requirements and maintain short term rental compliance within their ecosystem.

- Thoroughly review the terms of service and hosting guidelines of each platform you use.

- Ensure your listings are accurate and comply with platform standards regarding content and disclosures.

- Adhere to platform policies on cancellations, communication, and guest interactions.

Transparency and guest communication

Clear and transparent communication with your guests is not just good hospitality; it's also often a regulatory expectation. Hosts are typically required to provide guests with clear information about:

- House rules

- Expectations

- Any relevant legal disclaimers

This includes details about check-in and check-out procedures, quiet hours, parking restrictions, and any specific rules related to your property or local ordinances. Providing this information upfront helps to manage guest expectations, prevent misunderstandings, and ensure a smoother stay for everyone. Tools like Touch Stay digital guidebooks can be invaluable in effectively communicating these essential details to your guests and demonstrating your commitment to transparency and short term rental compliance.

- Clearly communicate all house rules, expectations, and any relevant local ordinances to guests.

- Provide detailed information about check-in/check-out procedures, parking, and other important details.

- Utilise tools like Touch Stay digital guidebooks to centralise and share this information effectively.

Take your short-term rental hosting to the next level with Touch Stay

How to stay compliant with short-term rental regulations

Navigating the complexities of short term rental rules might seem daunting, but there are proactive steps you can take to ensure you remain compliant and operate your business with confidence.

Implementing these strategies will not only help you avoid potential penalties but also streamline your operations and enhance your guests' experience.

- Maintain up-to-date licences and documents: Keep meticulous records of all your short-term rental licences, permits, insurance policies, and any other relevant documentation. Set reminders for renewals and ensure all information is current and readily accessible.

- Automate tax reporting where possible: Explore software solutions or accounting services that can help automate the collection and remittance of transient occupancy taxes and manage your income tax obligations related to your short-term rental income. This can save you time and reduce the risk of errors.

- Stay informed on local law changes: Short-term rental regulations are not static. Subscribe to local council newsletters, join host associations, and regularly check official government websites for any updates or changes to short term rental policy in your area.

- Monitor HOA communication and adjust accordingly: If your property is within an HOA, actively monitor their communications, attend meetings if possible, and ensure your hosting practices continue to align with their rules and any amendments they may introduce.

- Regularly review platform policy updates: Booking platforms frequently update their terms of service and hosting guidelines. Make it a habit to regularly review these updates to ensure your listings and practices remain compliant with their requirements.

- Use professional tools to streamline compliance: Leverage technology solutions designed to help short-term rental hosts manage various aspects of their business, including compliance-related tasks.

Create your digital guidebook today to enhance your guest experience, maximise your revenue and stay on top of short-term rental regulations.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates