Airbnb rental arbitrage is an exciting opportunity for entrepreneurs looking to enter the short-term rental market without owning property.

Renting properties and then subletting them on Airbnb can create a profitable business model based on the difference between your rental costs and your Airbnb income.

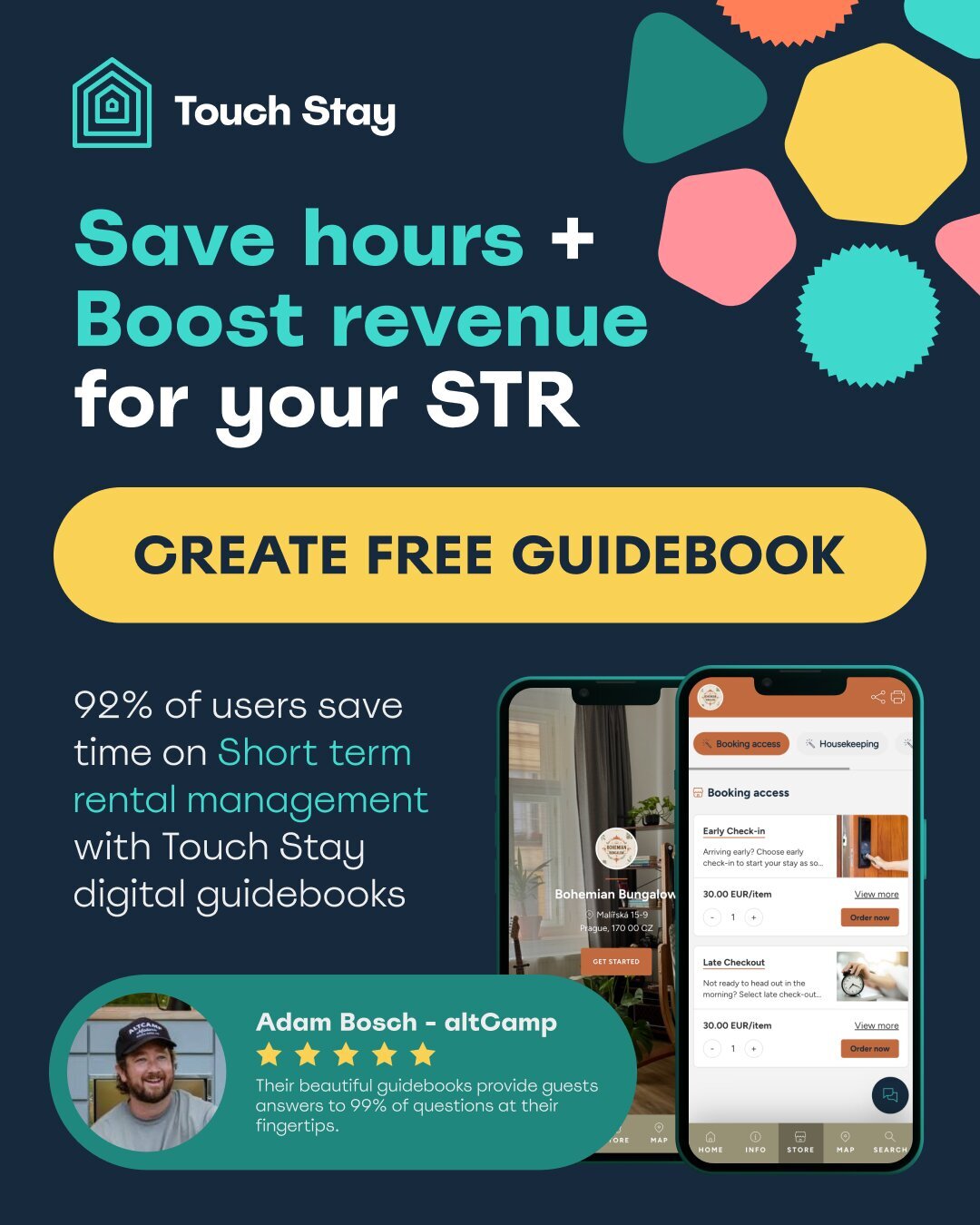

👋 Want to make managing guests easier as you grow your arbitrage business?

With a Touch Stay digital guidebook, you can automate guest communication, cut down on repetitive messaging, and deliver a 5-star experience.

Drop your Airbnb link to get started.

Get your custom guest guide in 60 seconds. No card required.

Want hands on support? Book a Demo to see how Touch Stay fits into your rental setup.

In this article, we’ll walk you through the basics of Airbnb rental arbitrage, including key strategies, potential earnings, and the steps needed to get started:

- What is Airbnb rental arbitrage?

- Why does rental arbitrage exist?

- Pros & cons of Airbnb arbitrage

- How to start Airbnb arbitrage

- How to calculate ROI for rental arbitrage

- Frequently asked questions

💡Tip: Streamline guest communications with Touch Stay guidebooks.

What is Airbnb rental arbitrage?

Airbnb rental arbitrage involves leasing a property long-term and then renting it out short-term on platforms like Airbnb.

The primary goal is to generate profit from the difference between the cost of your long-term lease and the income you earn from short-term rentals.

Here is how Airbnb rental arbitrage works in a nutshell:

- Lease a property: find a property in a high-demand area and negotiate a long-term lease with the landlord. Check to see that the lease agreement permits subletting.

- Complete legal requirements: depending on your area, you may need to get permits, Employer Identification Numbers, and more. Check your local laws or consult with a lawyer or accountant.

- Furnish and prepare: invest in furnishing the property to make it appealing to short-term guests. This includes comfortable furniture, essential amenities, and attractive decor.

- List on Airbnb: create a compelling listing on Airbnb, highlighting unique features and amenities. Use high-quality photos and detailed descriptions to attract guests.

- Manage bookings and guests: using Airbnb’s platform you can easily manage bookings and guest communications.

Airbnb rental arbitrage allows you to capitalise on high-demand rental markets without the significant capital required to purchase properties.

It offers a scalable business model that can generate substantial income if managed effectively.

Is Airbnb rental arbitrage legal?

Local laws and regulations regarding short-term rentals can change frequently, and arbitrage is outright forbidden in many lease agreements.

Additionally, managing an Airbnb in this situation also opens you up to many liabilities.

Please proceed with caution and get legal advice if necessary before starting your arbitrage ventures.

Why does rental arbitrage exist?

Short-term rentals are not a new concept in the travel world, and people find them attractive for plenty of reasons:

- They can be 40% cheaper than hotels (especially for longer stays), and offer more privacy and “homey” amenities, like a full kitchen and laundry.

- Short-term rentals can be in more appealing locations – 60% of travellers asked preferred to rent in quieter parts of a city, or away from overly touristy neighbourhoods.

- Some like that it’s easier to host friends or family, rather than having a small hotel room. 65% of respondents agreed, and stated they preferred short-term renting to hotels for this reason.

This industry is also quite profitable – and profits from Airbnb arbitrage typically range from 15-35% margins.

For example, if you rent a property for $1,200 a month and sublet it on Airbnb for a daily rate of $160, you can cover your rent in just eight days!

If you have guests for 20 days a month, you would earn $3,200. After deducting your rent and $400 in business expenses, you'd still net a profit of $1,600.

Of course, there are a multitude of factors that come into play when it comes to profits, and this example should be taken with a grain of salt.

Pros & cons of Airbnb rental arbitrage

With any reward, there are also risks to take into account.

Consider these factors, as well as monetary and legal factors that could hinder your progress.

Benefits of rental arbitrage

Let’s start with the good news. Airbnb rental arbitrage offers several significant advantages.

For instance, according to recent statistics, there are over 7 million Airbnb listings worldwide, and hosts collectively earned $180 billion as of 2024.

This model provides a lucrative opportunity for entrepreneurs, allowing them to capitalise on the booming short-term rental market without the need to purchase properties.

The other main benefits of Airbnb arbitrage are:

- Lower initial investment

Unlike traditional property investments, Airbnb rental arbitrage does not require you to buy property, which greatly reduces the upfront costs. You only need to cover the initial lease deposit, furnishings, and minor improvements, which can be much more affordable compared to a property purchase, and get your business up and running faster. - Scalability

Renting additional properties allows for rapid expansion without the need for large capital investments. You can reinvest profits from one property to lease and furnish more properties, thereby scaling your business faster than traditional property investment methods. - Flexibility

Entering and exiting markets is relatively easy with rental arbitrage. If a particular location becomes less profitable due to market changes or new regulations, you can end your lease and move to a more promising area without the complications and costs associated with selling property.

Drawbacks of rental arbitrage

On the other hand, there are some factors to be wary of as you start your journey. Despite the high earning potential, Airbnb rental arbitrage comes with its challenges.

Regulatory risks can be a significant hurdle, as can managing multiple properties. Financial risks also exist, which can impact profitability.

Being aware of the risks is all part of the process, and the more informed you are, the more ready you’ll be for any unforeseen consequences.

Here are the most important risk factors that you should take into consideration:

- Regulatory risks

As more cities across the world tighten their short-term rental policies, compliance with local laws and regulations is crucial and can be challenging.

Many cities have specific rules regarding short-term rentals, and these regulations can change, potentially disrupting your business. You must stay informed about local laws and make sure you have the necessary permits and licenses. - Management intensive

Managing an Airbnb rental arbitrage business requires handling frequent guest turnovers, bookings, cleaning, and maintenance. This can be time-consuming and may require hiring additional help or using property management services, which can increase costs. - Financial risks

We’ll talk more about risks below, but they’re certainly a con. Profitability can be affected by lower-than-expected occupancy rates, particularly in off-peak seasons or less popular locations.

You need to carefully analyse market demand, set competitive prices, and manage your expenses to ensure good profitability. Unexpected expenses, such as repairs or regulatory fines, can also impact your bottom line.

Knowing the advantages and disadvantages of Airbnb rental arbitrage helps in making informed decisions and preparing for potential challenges.

How to start Airbnb arbitrage

Embarking on an Airbnb rental arbitrage venture requires careful preparation and strategic planning.

To get started, you need to dive into thorough market research to identify profitable locations and understand local demand.

Estimating startup costs is one major aspect, as is optimising your property listings to attract guests.

Additionally, incorporating automation tools can streamline your operations, making it easier to manage bookings and guest communications.

1. Research the market & properties

Thorough market research is crucial for identifying the best locations for Airbnb rental arbitrage.

Look for areas with high demand for short-term rentals, favourable regulations, and a good balance of supply and demand. Tools like AirDNA can provide valuable insights into market trends, occupancy rates, and average rental incomes in various cities.

- Demand analysis: evaluate the demand for short-term rentals in potential markets.

- Competitive landscape: analyse the competition to understand pricing strategies and occupancy rates.

- Local regulations: research local laws and regulations to ensure short-term rentals are allowed and to identify any specific requirements or restrictions.

Ideal markets are characterised by high tourist traffic, strong demand for short-term rentals, and favourable regulations.

These are the top hotspots for Airbnb rental arbitrage around the world:

|

Destination |

Quarterly Growth |

Average Daily Rate |

|

Reykjavik, Iceland |

31% |

£165 |

|

Dublin, Ireland |

22% |

£181 |

|

Amsterdam, Netherlands |

8% |

£206 |

|

Edinburgh, UK |

11% |

£151 |

|

Belfast, UK |

19% |

£127 |

|

Washington D.C., USA |

2% |

£148 |

|

Stockholm, Sweden |

18% |

£113 |

|

Luxembourg, Luxembourg |

13% |

£120 |

|

Copenhagen, Denmark |

18% |

£130 |

|

Oslo, Norway |

39% |

£109 |

Source: CIA Landlords

When selecting a market, consider factors such as local events, tourist attractions, business centres, and the regulatory environment.

Note: The short-term rental market can be unpredictable. Factors such as seasonality, economic conditions, and local events can severely impact occupancy rates and pricing. Diversifying your portfolio across different markets can help mitigate this risk.

The best properties for Airbnb rental arbitrage are those that meet the following criteria:

- Centrally located: properties near tourist attractions, business districts, or public transportation hubs tend to attract more guests.

- Well-maintained: properties that are in good condition and require minimal upfront investment for repairs.

- Amenities: homes with sought-after amenities such as Wi-Fi, parking, a fully-equipped kitchen, and modern appliances often receive higher booking rates and better reviews.

2. Check local regulations

Public opinion about short-term rentals is tense in many major cities across the globe, and as a result, laws tend to change quickly. Cities may impose restrictions, require specific permits, or even ban short-term rentals altogether in the future.

It’s extremely important to stay updated on local regulations and remain compliant to avoid fines or legal issues.

At the time of writing, these popular locations have varying degrees of regulations on arbitrage:

|

Location |

Legality |

Notes |

|

Yes |

State-friendly, but local regulations vary. LA requires permits; San Francisco has restrictions on rental duration and business registration. |

|

|

Yes |

Generally lax regulations. Requires a state license for rentals under 30 days and local taxes. Miami Beach has stricter controls. |

|

|

Yes |

Minimal state regulations; cities like Austin require operating licenses and tax registration. |

|

|

Yes |

No state-wide regulations aside from a hotel/motel and sales tax; local ordinances vary, such as Atlanta’s licensing requirements and Savannah’s restrictive caps. |

|

|

Yes |

Varies by town; some places have banned short-term rentals or imposed stringent regulations, short-term rental permits required for all guests under 30 days. |

|

|

Yes |

Strict laws; short-term rentals under 30 days without owner presence are mostly prohibited. New regulations require host registration. |

|

|

Yes |

Region-specific regulations; Greater London has a 90-night limit, while other cities require planning approval and host registration. |

|

|

Yes |

Municipal regulations vary; Quebec requires registration, and Vancouver allows only main residences for short-term rentals. |

|

|

Yes |

Specific laws per state; New South Wales allows councils to decide, with sanctions for non-compliance and mandatory rental income declaration to the ATO. |

|

|

Yes |

Requires registration numbers for listings; stricter laws since 2021 with fines for non-compliance. |

|

|

Yes |

Requires registration as tourist accommodation; local officials can access listing data. |

|

|

Yes |

Requires permits for short-term rentals; revised laws in 2021 mandate registration numbers by March 2023. |

|

|

Yes |

Requires registration and permits for vacation rentals; limited to 30 days per year since 2018. |

Here are some useful links to pages from major platforms that provide information about rules and regulations for short-term rentals:

- Airbnb: What hosting regulations apply to you?

- HomeAway (Vrbo): Rules for Short-Term Rentals

- Booking.com: Navigating Short-Term Rental Legislation

- Expedia: Short-Term Rental Regulations

- TripAdvisor: Vacation Rental Rules and Regulations

- FlipKey: Short-Term Rental Guidelines

- Booking.com: Short-Term Rental Regulations

3. Estimate starting costs & pricing

Typical startup costs for rental arbitrage include:

- Lease deposit: generally, one to two months’ rent is required upfront.

- Furnishings: budget for essential furniture, decor, and amenities. This can range from $7,000 to $11,000 for a one-bedroom apartment, but naturally, your results may vary.

- Licenses and permits: fees for any required local permits and licenses.

- Insurance: short-term rental insurance to protect against potential damages and liabilities.

- Maintenance: short and long-term upkeep, like cleaning, small and large repairs, and other wear and tear.

- Marketing and photography: high-quality photos and marketing efforts to create an attractive listing.

Setting the right price is essential to attract guests and maximise your income. Consider things such as:

- Market rates: compare similar listings in your area to determine competitive rates. Use tools like AirDNA or PriceLabs for market analysis.

- Seasonality: adjust your rates based on seasonal demand. Higher rates during peak seasons and special events can significantly boost your income.

- Dynamic pricing: use dynamic pricing tools that automatically adjust your rates based on real-time market demand, local events, and occupancy rates.

The goal is to get yourself a healthy profit without gouging your customers, especially at a time when people are back to choosing hotels over Airbnb, in part due to ridiculously high and unfair fees.

4. Create & optimise your listings

Creating an appealing and detailed listing is key to attracting guests. Focus on the following elements:

- High-quality photos: use professional photos to showcase your property’s best features.

- Enticing description: write a detailed and engaging description highlighting unique features and amenities.

- Guest reviews: encourage guests to leave positive reviews to build credibility and attract more bookings.

While Airbnb is a major player in the short-term rental market, there are other platforms you can utilise for rental arbitrage:

- Vrbo: ideal for vacation rentals, offering properties ranging from condos to villas. Vrbo focuses on providing unique vacation experiences.

- Booking.com: a comprehensive travel platform that includes hotels, hostels, and vacation rentals, allowing for a wider audience reach.

- Expedia: known for its extensive travel services, including vacation rentals, it attracts travellers looking for complete travel packages.

In addition to these platforms, be sure to market your listings on other places like social media, promote them in various newsletters, and optimise them not only on the Airbnb website but on different sites as well for SEO purposes.

5. Automate the rental process

While Airbnb has an entire platform for use, automation tools can streamline operations and reduce the workload involved in managing multiple properties.

Key areas to automate include:

- Pricing tools: dynamic pricing tools like PriceLabs or Beyond Pricing can adjust rates based on demand and competition.

- Booking management: use software to sync calendars across multiple platforms and manage bookings efficiently. Some popular tools include Guesty and Lodgify.

- Guest communication: automated messaging systems or message templates can handle inquiries, booking confirmations, and check-in instructions. Besides the Airbnb app, you can check out other services like Jurny or Host Tools.

6. Create a Touch Stay welcome book

Lastly, you can really go the extra mile and create a beautiful, memorable welcome guide using Touch Stay.

With our customisable welcome books, you can host guests in every language, share practical information and local recommendations, and decorate with your own personal flair.

A welcome book should cover all the information guests might need. Here are some essential elements and features to include:

- Check-in and check-out instructions: provide clear guidelines for arrival and departure to provide a smooth experience.

- House rules: outline the dos and don’ts to maintain order and respect for your property.

- Wi-Fi information: share Wi-Fi network names and passwords for easy internet access.

- Local attractions and recommendations: highlight popular spots, dining recommendations, and local events to make your guests' stay more enjoyable.

- Emergency contacts: include important phone numbers for local emergency services and your personal contact.

- Appliance guides: provide instructions for using household appliances and electronic devices.

- Transport information: offer details on public transport, taxi services, and parking facilities.

- Welcome message and personal touches: add a personalised welcome note to make guests feel at home.

Ready to get started?

How to calculate ROI for rental arbitrage

Your profit will depend on the number of vacation rentals you have and their locations.

Rental arbitrage has great potential, and with the right strategy, you can earn two to three times more than your expenses.

For example, if your monthly rent is $1,500, and you rent out your property for $200 per night on weekends, hosting guests for 10 nights a month could earn you $2,000. After covering your rent, you'd have $500 for expenses and profit.

Here’s a simple formula for estimating your Airbnb rental arbitrage profitability:

- Calculate average daily rates: look at Airbnb listings in your area to find average weekday and weekend rates throughout the year. For instance, if the weekday rate is $60 and the weekend rate is $120, your weighted average rate would be $74.

Weighted Average Rate: ($60 × 5 + $120 × 2) / 7 = $74

- Determine daily property costs: divide your monthly expenses by 30. For example, if your total costs are $2,100 per month, your daily cost is $70.

Daily Cost: $2,100 / 30 = $70

- Calculate the final ratio: divide the weighted average rate by your daily property cost.

Final Ratio: $74 / $70 = 1.06

A ratio above 1 means you can turn a profit. For instance, with a ratio of 1.06, you’re profitable. Ideally, aim for a ratio of 2.0 or higher for a better margin and financial cushion.

Frequently asked questions

Is rental arbitrage worth it?

Rental arbitrage can be very profitable if done correctly. It offers the potential for high returns compared to traditional renting, but it requires active management, thorough market research, and compliance with local regulations.

Can you scale rental arbitrage fast?

Yes, scaling can be faster than traditional property investment because you don’t need to buy properties. Reinvesting profits from one property can help lease and furnish additional properties, allowing for rapid expansion.

Do you need an LLC for Airbnb arbitrage?

While forming an LLC for Airbnb arbitrage isn’t legally mandatory, it offers liability protection and potential tax benefits. An LLC helps separate your personal assets from your business operations, providing a layer of security.

Why would a landlord agree to rental arbitrage?

Landlords might agree to rental arbitrage as it guarantees consistent rental income and minimises vacancy risks. It’s also appealing if the tenant handles property maintenance and management.

How much does it cost to start an Airbnb arbitrage?

Starting an Airbnb arbitrage typically involves costs such as the first month’s rent, a security deposit, property furnishings, and necessary permits or licenses. On average, initial expenses range from $5,000 to $10,000.

How can I find rental arbitrage properties?

To find rental arbitrage properties, explore online rental listings, network with real estate agents, and attend local real estate meet-ups. Target properties in high-demand areas with favourable short-term rental regulations.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates