As the sharing economy revolutionises the way we explore the world, Airbnb has emerged as a game-changer, offering unique and personalised accommodation experiences worldwide. However, with this innovative approach to lodging comes a new set of considerations for travellers.

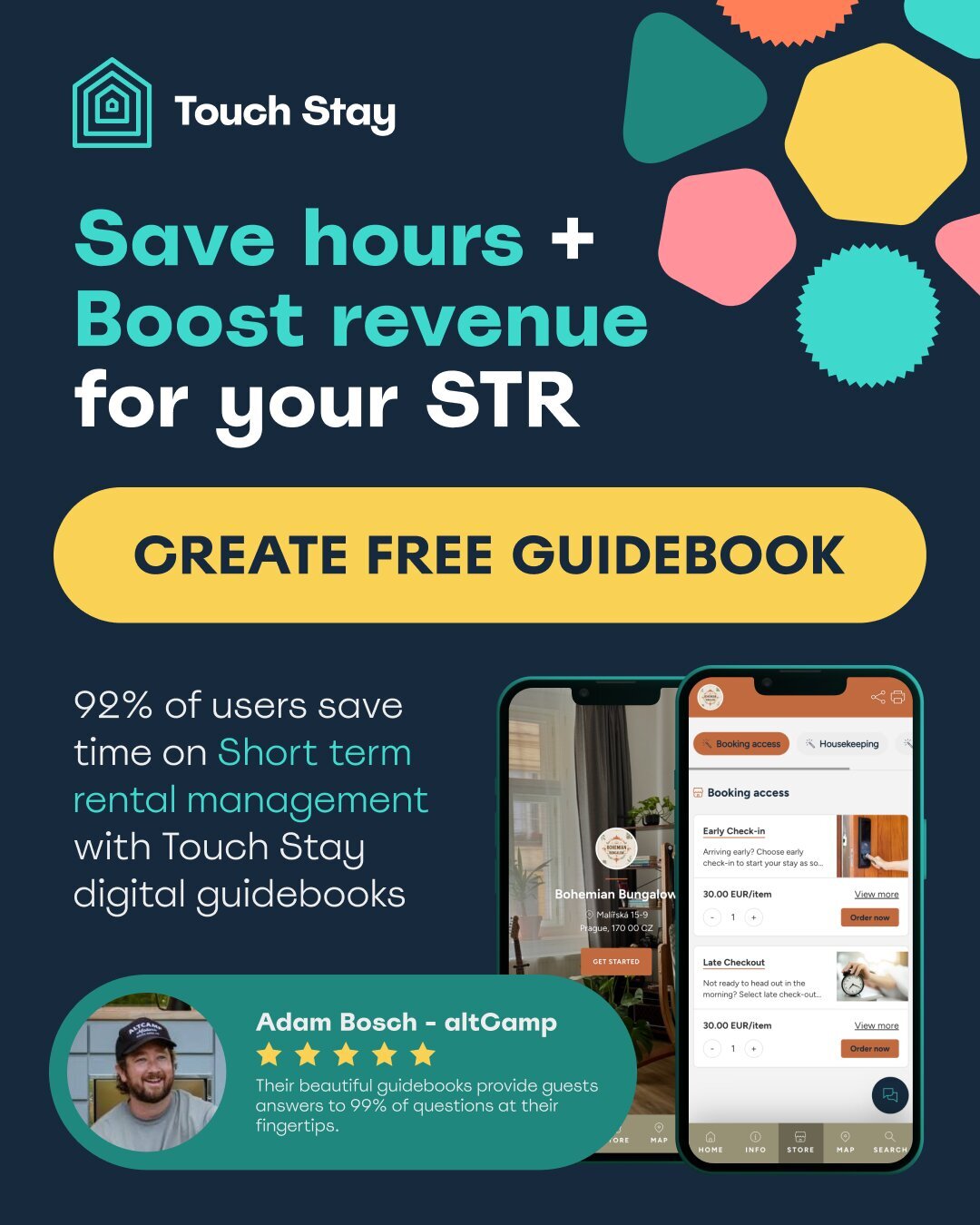

Chief among these is the need for appropriate travel insurance. This comprehensive guide delves into the world of travel insurance for your Airbnb stay from both the perspective of traveler and vacation property owner, providing you with essential information to ensure your next Airbnb adventure is both enjoyable and protected. For a seamless way to communicate this and other essential travel information, try out one of our easy to follow guide books.

Read on to discover:

- What is travel insurance for your Airbnb stay?

- Pros and cons of travel insurance for your Airbnb stay

- What does travel insurance for your Airbnb stay cover?

- Aircover vs. travel insurance for your Airbnb stay: what is the difference?

- How to get travel insurance for your Airbnb stay

- How to cancel travel insurance for your Airbnb stay

- Alternatives to travel insurance for your Airbnb stay

- How to choose the right travel insurance for your Airbnb stay

- FAQs about travel insurance for your Airbnb stay

What is travel insurance for your Airbnb stay?

Travel insurance for your Airbnb stay is a specialised form of coverage designed to address the unique aspects and potential risks associated with staying in a shared or private accommodation booked through the Airbnb platform. It can be defined as a type of travel protection tailored to cover risks and situations unique to Airbnb stays. The primary purpose of this insurance is to provide financial security and peace of mind for guests using the Airbnb platform.

Unlike traditional travel insurance, which primarily focuses on flight cancellations and hotel bookings, travel insurance for your Airbnb stay encompasses a broader range of scenarios specific to the home-sharing experience. The key difference is that it addresses specific concerns related to staying in someone else's property, such as property damage liability or host cancellations. This makes it particularly suited to the unique nature of Airbnb accommodations and the potential issues that may arise from such arrangements.

Check out this video that explains the basics of travel insurance for your Airbnb stay:

Pros and cons of travel insurance for your Airbnb stay

One of the most common questions travellers ask is whether travel insurance for your Airbnb stay is a worthwhile investment. To help you make an informed decision, let's explore the pros and cons:

Pros:

- Provides coverage for Airbnb-specific scenarios not typically included in standard travel insurance.

- Offers peace of mind, knowing you're protected against unforeseen circumstances.

- Can cover costs associated with property damage, which is a unique risk when staying in someone's home.

- May include protection against host cancellations or misrepresented listings.

Cons:

- Adds an extra cost to your travel budget.

- May overlap with coverage you already have through credit cards or existing insurance policies.

- Some policies may have high deductibles or limited coverage amounts.

- Not all policies are created equal, and some may have significant exclusions.

To truly understand the value of travel insurance for your Airbnb stay, it's helpful to consider scenarios where this coverage can be particularly beneficial:

- Last-minute cancellations: imagine you've booked a non-refundable Airbnb for a family reunion, but a close relative falls ill, forcing you to cancel your trip. With the right travel insurance for your Airbnb stay, you could recoup your non-refundable expenses.

- Property damage incidents: you accidentally spill red wine on your host's white carpet. travel insurance for your Airbnb stay can cover the cost of cleaning or replacement, protecting you from out-of-pocket expenses.

- Medical emergencies abroad: while staying at an Airbnb in a foreign country, you suffer a severe allergic reaction requiring hospitalisation. Travel insurance for your Airbnb stay could cover medical costs not included in your regular health insurance.

- Host cancellations: your host cancels your booking last-minute due to unforeseen circumstances. The right insurance policy can cover additional costs incurred in finding alternative accommodation.

- Natural disasters: extreme weather conditions force you to evacuate your beachfront Airbnb. Insurance can cover the cost of alternative accommodation and potential trip interruption expenses.

Note: travel insurance for your Airbnb stay differs depending on where you are in the world. For example, guests from the UK, Ireland, Austria, Italy, Spain, Portugal, Germany and the Netherlands can buy reservation insurance (for an additional cost) that protects against certain risks when booking a trip. However, for guests making bookings in the US, Airbnb insurance policies don’t always cover the same things.

What does travel insurance for your Airbnb stay cover?

Understanding what travel insurance for your Airbnb stay covers is crucial for making an informed decision about your travel protection needs.

While coverage can vary between providers, there are several common elements found in most travel insurance for your Airbnb stay policies.

Typical coverage areas include:

- Trip cancellation and interruption: reimburses non-refundable expenses if you need to cancel or cut short your trip due to covered reasons such as illness, injury, or severe weather.

- Emergency medical expenses: covers medical treatment costs if you fall ill or get injured during your Airbnb stay.

- Emergency medical evacuation: pays for transportation to the nearest adequate medical facility or back home if necessary.

- Baggage loss or delay: provides compensation for lost, stolen, or delayed luggage.

- Travel delay: covers additional accommodation and meal costs if your trip is delayed due to covered reasons.

- Property damage protection: insures against accidental damage you might cause to your Airbnb accommodation.

- 24/7 travel assistance services: offers round-the-clock support for various travel-related issues.

- Host cancellation protection: covers additional costs if your Airbnb host cancels your booking at short notice.

- Misrepresentation coverage: provides compensation if the Airbnb property significantly differs from its listing description.

Aircover for guests vs. travel insurance for your Airbnb stay: what is the difference?

When booking through Airbnb, guests should be aware of two distinct types of protection: travel insurance for your Airbnb stay and AirCover for guests. Understanding the differences between these and how they can complement each other is crucial for ensuring comprehensive coverage during your stay.

AirCover for guests:

AirCover is a basic protection program provided by Airbnb and included in most bookings at no extra cost. It offers limited coverage focusing mainly on booking-related issues:

- Booking protection guarantee: Airbnb will find you a similar or better home, or refund you if your host cancels within 30 days of check-in.

- Check-in guarantee: if you can't check into your accommodation and the host can't resolve the issue, Airbnb will find you an alternative or provide a refund.

- Get-what-you-booked guarantee: if your listing doesn't match the description, you have three days to report it for similar accommodation or a refund.

- 24-hour safety line: priority access to trained safety agents if you feel unsafe.

Travel insurance for your Airbnb stay:

This is a separate, more comprehensive insurance policy that guests can purchase to cover a wider range of travel-related risks. While not offered directly by Airbnb, it's designed to address the unique aspects of staying in shared accommodations. It typically includes:

- Trip cancellation and interruption coverage

- Emergency medical expenses and evacuation

- Baggage loss or delay

- Personal liability protection

- Accidental death and dismemberment coverage

How they work together:

AirCover provides basic protections related to your booking and stay, while travel insurance for your Airbnb stay offers more comprehensive coverage for various travel risks. By having both, guests can enjoy the immediate booking protections of AirCover while also being covered for broader travel-related issues through their travel insurance policy.

Want to simplify this for your guests?

Travel insurance and Airbnb policies can be confusing — but your guests don’t need to get lost in the details.

Touch Stay lets you create a digital welcome book that clearly outlines what’s covered, what to expect, and how to stay safe — all from one easy-to-access link.

Book a Demo and see how you can boost clarity and trust before guests even arrive.

How to get Airbnb travel insurance?

While Airbnb doesn't offer its own comprehensive travel insurance globally, travelers from the US do have the convenient option to purchase travel insurance directly through Airbnb during the booking process. This streamlined approach allows you to seamlessly secure coverage tailored to your upcoming stay.

For non US based travelers, you can obtain coverage for your Airbnb stay through third-party providers. Here's how to get travel insurance for your Airbnb stay:

- Research providers: look for insurance companies that offer policies specifically designed for vacation rentals or home-sharing platforms. Some popular options include World Nomads, Allianz, and InsureMyTrip.

- Compare policies: carefully review the coverage options, paying attention to what's included and excluded. Look for policies that cover trip cancellation, property damage, and personal liability.

- Consider your needs: think about the specifics of your trip, such as the duration of your stay, the value of your belongings, and any activities you plan to do.

- Get a quote: most insurance providers offer online quotes. Enter your trip details, including travel dates and destination, to get an estimate.

- Read the fine print: before purchasing, thoroughly read the policy documents to understand the terms, conditions, and claim process.

- Purchase the policy: once you've chosen a suitable policy, complete the purchase process, typically done online.

- Save documentation: keep all policy documents and contact information in a safe, easily accessible place for your trip.

How to file a claim for travel insurance for your Airbnb stay

If you need to file a claim on your Airbnb travel insurance, follow these steps:

- Review your policy: familiarise yourself with your coverage and the claim process outlined in your policy documents.

- Gather documentation: collect all relevant documents, which may include:

- Proof of travel (e.g., Airbnb booking confirmation)

- Receipts for expenses related to your claim

- Police reports (if applicable)

- Medical reports (if claiming for medical expenses)

- Photographs of damaged items (if claiming for property damage

- Contact your insurance provider: notify your insurer as soon as possible. Many have 24/7 emergency assistance lines.

- Fill out claim forms: complete all required claim forms provided by your insurance company. Be thorough and accurate.

- Submit your claim: send in your completed forms along with all supporting documentation. Many insurers allow online submission.

- Follow up: keep track of your claim's progress and respond promptly to any requests for additional information.

- Appeal if necessary: if your claim is denied and you believe it should be covered, don't hesitate to appeal the decision.

Remember, the specific process may vary depending on your insurance provider, so always refer to your policy documents for exact instructions.

How to cancel travel insurance for your Airbnb stay

If you need to cancel your travel insurance for your Airbnb stay, the process will depend on the terms of your policy and the insurance provider. Here are general steps to follow:

- Check the cancellation policy: review your policy documents for information on cancellations, including any deadlines or fees.

- Contact your insurance provider: reach out to your insurer's customer service department. Many providers have dedicated cancellation hotlines.

- Provide necessary information: be prepared to give your policy number, the reason for cancellation, and any other required details.

- Understand the refund policy: depending on when you cancel, you may be eligible for a full or partial refund. Some policies offer a "free look" period, typically 10-14 days after purchase, during which you can cancel for a full refund.

- Request written confirmation: ask for an email or letter confirming your policy cancellation and any refund details.

- Check your refund: if you're entitled to a refund, confirm the amount and when you can expect to receive it.

- Consider alternatives: if you're cancelling because your trip is cancelled, check if your policy allows you to change dates instead of cancelling outright.

Remember, it's crucial to cancel your policy as soon as you know you won't need it. Waiting too long may reduce your refund or eliminate it entirely. Always refer to your specific policy terms, as cancellation procedures can vary between insurance providers.

Alternatives to travel insurance for your Airbnb stay

While Airbnb-specific insurance can be beneficial, it's not the only option for protecting your stay. Understanding alternatives can help you make a more informed decision about your travel protection needs.

Another approach is to use comparison sites like insuremytrip.com where U.S. based travelers can find policies that cover more extensive needs, including dangerous activities and the CFAR option.

Short-term home insurance

Short-term home insurance is an alternative that can provide coverage for both hosts and guests during an Airbnb stay.

- Coverage: typically includes property damage, liability, and sometimes theft.

- Flexibility: can be purchased for the exact duration of your stay, whether it's a weekend or several months.

- Cost-effective: often cheaper for longer stays compared to daily travel insurance rates.

- Comprehensive: may offer more extensive coverage than standard travel insurance for home-related incidents.

Example scenario:

A family rents an Airbnb for a month-long summer holiday in a coastal town. They opt for short-term home insurance to cover potential damages to the property (such as accidental breakages or water damage) and liability issues (like a guest slipping on a wet floor).

This provides more comprehensive coverage than standard Airbnb protections, especially for an extended stay where the risks of something going wrong are higher.

Other alternatives to consider include:

- Credit card travel insurance: many premium credit cards offer travel insurance as a perk. Check your card benefits to see what's covered.

- Annual multi-trip insurance: if you travel frequently, an annual policy might be more cost-effective than purchasing separate insurance for each trip.

- Umbrella insurance: this type of policy can extend your liability coverage beyond your regular home or auto insurance, potentially covering incidents during Airbnb stays.

How to choose the right travel insurance for your Airbnb stay

Selecting the right insurance for your Airbnb adventure requires careful consideration of your specific needs and travel plans.

Consider these different types of travel insurance that can complement or replace Airbnb's basic coverage:

- Comprehensive travel insurance: offers the most extensive coverage, including trip cancellation, medical emergencies, baggage loss, and more.

- Cancel for any reason (CFAR) coverage: allows you to cancel your trip for any reason and receive a partial refund, typically 50-75% of your trip cost.

- Adventure sports coverage: essential if you're planning activities like skiing, scuba diving, or mountain climbing during your Airbnb stay.

- Digital nomad insurance: designed for long-term travellers who work remotely, offering extended medical coverage and protection for electronic devices.

- Annual multi-trip insurance: cost-effective for frequent travellers, covering multiple trips within a year.

- Credit card travel protection: many credit cards offer basic travel insurance, which might be sufficient for some Airbnb stays.

Top tips for choosing the best policy:

- Assess your trip's specific risks and activities

- Compare multiple policies and providers

- Read the fine print, especially regarding Airbnb stays and any exclusions

- Consider your destination's healthcare system and costs

- Factor in the value of your belongings and trip investments

- Check for coverage overlaps with existing insurance policies

- Consider the length of your stay and booking flexibility

- Evaluate the insurance provider's reputation and customer service

Is travel insurance for your Airbnb stay worth it?

Before making your decision, consider these key points:

- The total cost of your trip and potential financial loss

- Your personal risk tolerance and desire for peace of mind

- Existing coverage from credit cards or health insurance

- The nature of your trip (adventure activities, remote locations, etc.)

- Length of stay and booking flexibility

- Your health condition and that of your travel companions

- The political and natural disaster risk of your destination

- The value of items you're bringing on your trip

Remember, the goal is to find a balance between adequate protection and cost-effectiveness. Don't over-insure, but also avoid leaving significant risks uncovered.

Find the perfect level of travel insurance for your requirements with an insurance comparison site like Squaremouth.

Final thoughts

Travel insurance for your Airbnb stay plays a vital role in protecting your home-sharing experience. While Airbnb offers basic coverage through AirCover, it may not be sufficient for all travellers or situations. By understanding the options available – from Airbnb's built-in protections to comprehensive travel insurance policies – you can make an informed decision that best suits your needs.

Whether you opt for additional coverage or rely on Airbnb's basic protections, the key is to travel with peace of mind, knowing you're prepared for whatever your journey may bring. Remember that the cheapest option isn't always the best – look for a policy that offers the right balance of coverage and cost for your specific needs.

Elevate your Airbnb hosting with Touch Stay. Provide your guests with personalised guidebooks, safety tips, and local insights to ensure they have a seamless, safe, and enjoyable stay. Sign up for a 14-day free trial and discover how Touch Stay can make a difference.

Frequently asked questions

The value of Airbnb travel insurance depends on individual circumstances. Consider it worthwhile if:

- Your trip is expensive or involves non-refundable bookings

- You're travelling to a destination with high medical costs

- You're engaging in adventure activities

- You're carrying valuable items

- You have pre-existing medical conditions

- Your trip involves multiple destinations or complex itineraries

Airbnb's basic AirCover for guests includes:

- Booking protection guarantee

- Check-in guarantee

- Get-what-you-booked guarantee

- 24-hour safety line

However, this is not comprehensive travel insurance and has limitations. It doesn't cover:

- Personal injuries

- Damage to personal property

- Trip cancellations due to personal reasons

- Medical emergencies

Consider purchasing additional Airbnb travel insurance if:

- You're booking an expensive or long-term stay

- You're travelling to a remote or unfamiliar destination

- You have concerns about potential trip cancellations or interruptions

- You want additional peace of mind beyond Airbnb's basic protections

- You're travelling with valuable items

- You have pre-existing medical conditions

- Your trip involves activities with higher risk of injury

Remember, the decision ultimately depends on your personal risk assessment and travel needs.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates