For the savvy short-term rental (STR) investor, 2026 promises a mix of both enduring challenges and lucrative new opportunities. As the market matures, the days of throwing any property onto a booking platform and watching the cash flow in are long gone. Success now hinges on strategy, data-driven decisions and, crucially, a flawless guest experience.

In this data-heavy blog, we cut through the noise to identify the 20 best short-term rental markets for investment in 2026. We’ve scoured the data, focusing on markets that offer a compelling mix of low entry costs, high yield potential, and strong traveller demand. This guide will cover:

- Methodology and criteria used for short-term rental markets

- 20 best short-term rental markets

- Key takeaways

Want to take the short-cut to boosting your STR income?

Methodology and criteria used for short-term rental markets

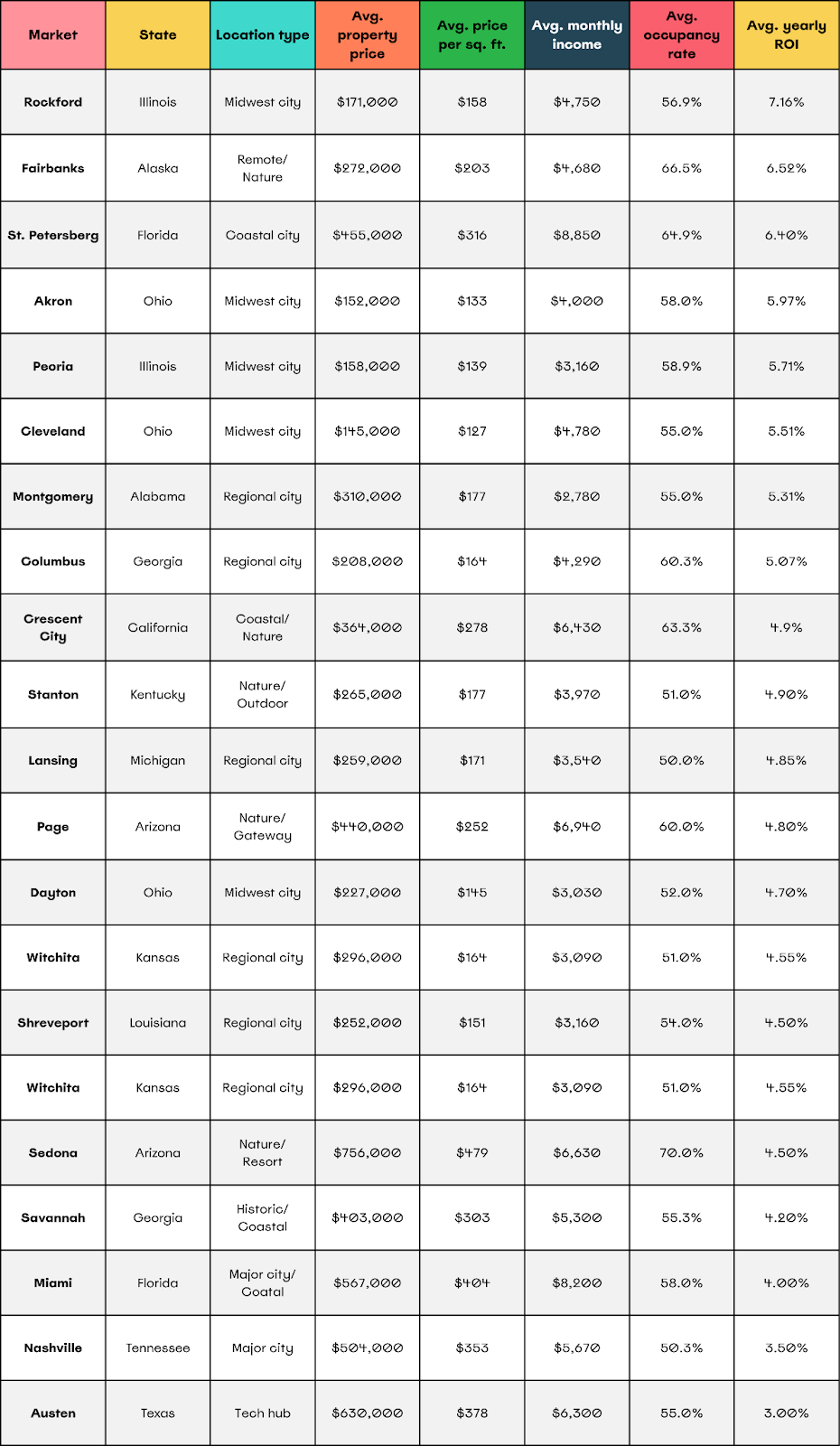

Selecting the most promising locations for short-term rental investment requires moving beyond anecdotal evidence and focusing on hard data. Our evaluation of markets considered hundreds of thousands of active listings, blending traditional property metrics with dedicated short-term rental performance indicators to give you a clearer picture of investment potential, as highlighted in reports like the AirDNA Best Places to Invest in Short-Term Rentals Report and Lodgify's Best Short-Term Rental Markets for Investing.

We’ve focused on markets that stand out for accessibility, growth, and predictable revenue streams, ensuring a balanced portfolio of affordable regional centres and high-demand holiday destinations.

The criteria used for evaluation, and for the data in our comparison table, include:

Average property price

This metric is calculated using the median sale price for properties in the market that are viable as short-term rentals. A lower average price often translates to a more accessible investment, particularly for first-time investors or those looking to expand a portfolio without excessive capital outlay.

Average price per square foot

While difficult to track with perfect consistency across all markets, this metric offers a quick comparison of the relative cost efficiency of purchasing property in a given area. It helps to standardise the cost of different property types and sizes.

Monthly rental income

This is the average gross monthly revenue generated by a comparable STR property in the market. This figure is a critical component of calculating potential cash flow and return on investment (ROI). Higher average income means the property is covering its costs and generating profit more quickly.

Occupancy rate

The average percentage of nights a short-term rental property is booked within a given period. A high occupancy rate signals consistent, year-round traveller demand, which is a hallmark of a robust STR market, as noted in analyses by Mashvisor.

Average yearly ROI

Often referred to as Capitalisation (Cap) Rate or Gross Yield in the industry, this is a core indicator of profitability. It represents the annual net operating income as a percentage of the property’s value, providing a direct measure of how quickly your investment can pay for itself. We've used Cap Rate/Gross Yield figures as the best approximation of yearly ROI for comparison, as detailed in reports from Lodgify.

Pro tip: Stay ahead in the short-term rental market with our 2026 STR Industry Report.

20 best short-term rental markets

The following markets represent some of the most compelling investment opportunities for 2026, balancing affordability with impressive performance metrics. All figures are based on 2026 projections from leading STR data platforms and are shown in US Dollars (USD).

Rockford, Illinois

Rockford stands out with an exceptional Average Yearly ROI of 7.16% - the highest on this list according to Lodgify’s 2026 analysis. While its occupancy rate sits a little lower at 56.9%, the high average daily rates (ADRs), driven by business travellers and visitors to its arts and outdoor scene, push annual revenue potential dramatically higher. Investors can expect a robust monthly income of around $4,750 from an accessible average property price of $171,000.

- Potential regulations: Regulations are generally favourable, but local registration and licensing are typical requirements for non-owner-occupied properties.

Fairbanks, Alaska

A unique market driven by experiential tourism, Fairbanks continues to deliver strong performance with an exceptional 66.5% occupancy rate. Travellers come seeking the Northern Lights, cultural heritage, and outdoor adventure, ensuring a year-round tourist flow. With an average property price of $272,000, it offers a balanced mix of steady returns and affordability, yielding an Average Yearly ROI of 6.52% and monthly income around $4,680, as noted in the AirDNA 2026 report.

- Potential regulations: Regulations are generally manageable, often focusing on fire safety and local business licensing rather than strict property caps.

St. Petersburg, Florida

A perennial favourite, St. Petersburg’s coastal charm, arts scene, and year-round tourist appeal keep it at the top of the performance charts. It generates high income potential, with an estimated $8,850 per month and a high 64.9% occupancy rate, resulting in an excellent 6.40% ROI. This market demands a higher initial investment, with an average property price around $455,000.

- Potential regulations: Florida markets are generally desirable, but St. Petersburg has specific zoning and licence requirements that hosts must adhere to, especially in coastal areas.

Akron, Ohio

Akron provides an outstanding balance of affordability and investment performance. With a low average property price of approximately $152,000 and a 5.97% ROI, it's highly accessible for new investors. The market is supported by a growing travel interest, evident in its approximately 58.0% occupancy rate and monthly income potential of $4,000. Akron’s strengthening economy and proximity to larger Ohio cities make it a solid choice.

- Potential regulations: Check for municipal-level permit and safety inspection rules, which are common across Ohio's growing metro areas.

Peoria, Illinois

Peoria stands out as a genuine cash-flow leader in 2026. It boasts one of the highest gross yields in the market, making it number one for sheer investment potential among many regional hubs. What sets it apart is the affordable entry point, with an average property price around $158,000, combined with steady demand from business and leisure travellers. The potential to generate approximately $3,160 in monthly rental income is highly attractive for a low-cost market, providing a 5.71% ROI.

- Potential regulations: Generally considered STR-friendly, but local zoning and permit requirements should always be double-checked before purchasing.

Cleveland, Ohio

Cleveland remains one of the most affordable major markets on this list, with an average property price of just $145,000 and a commendable 5.51% ROI. The revitalisation of the downtown area and a strong healthcare sector drive consistent demand, leading to high potential monthly income of $4,780 based on a strong average daily rate (ADR).

- Potential regulations: Cleveland has experienced downtown redevelopment, meaning regulations can be a moving target; keep abreast of local council decisions.

Montgomery, Alabama

Montgomery’s STR market is on the rise, fuelled by a good balance of surging occupancy and affordable property. The city’s rich historical attractions and strong regional travel ensure steady demand, supporting an ROI of 5.31% and average monthly income of $2,780. The average property price sits around $310,000.

- Potential regulations: Regulations are relatively favourable, but hosts should confirm local business licence requirements.

Columbus, Georgia

Columbus is a rising star, combining moderate property costs (around $208,000) with reliable performance metrics, including a 60.3% occupancy rate and a 5.07% ROI. Its stability is underpinned by the large US Army base, which ensures consistent demand from military families and visitors. The market is not yet saturated, providing a good opportunity for early movers to achieve a monthly income of $4,290.

- Potential regulations: STR permits for each unit are required, and limits on occupancy or a local contact person may be in force.

Crescent City, California

Offering an opportunity to establish a foothold in a high-performing coastal market before it reaches saturation, Crescent City provides strong numbers with an ROI of 4.94% and a 63.3% occupancy rate. While California has higher property prices ($364,000), the revenue potential of $6,430 per month is substantial, driven by its unique redwood forest and Pacific coast attractions.

- Potential regulations: Coastal California regulations can be very strict; comprehensive research into county and municipal short-term rental ordinances is essential.

Stanton, Kentucky

Stanton is a popular destination for outdoor enthusiasts, thanks to its proximity to the Red River Gorge and the Daniel Boone National Forest. This nature-driven tourism supports a decent 51.0% occupancy rate, giving investors a 4.90% ROI and around $3,970 in monthly income from properties that cater to hikers and adventurers. Average property price is around $265,000.

- Potential regulations: Being a smaller, nature-focused community, regulations are often less restrictive than in major metro areas.

Lansing, Michigan

Lansing, home to a major university, provides strong earning potential within an affordable market. Its strong gross yield points to a stable investment for properties catering to university visitors, state government employees, and regional tourists. Investors can look at a 4.85% ROI and $3,540 in monthly income from an average property price of $259,000.

- Potential regulations: University towns often have specific rules regarding rental types (e.g., student housing vs. STRs), so verify local zoning carefully.

Page, Arizona

Page is a small but mighty market, acting as the gateway to world-famous sites like Antelope Canyon and Horseshoe Bend. It has a high RevPAR (Revenue Per Available Rental) and a strong 60.0% occupancy rate, showcasing its ability to generate high revenue despite its size. This translates to an average monthly income of $6,940 and a 4.80% ROI with an average property price of $440,000.

- Potential regulations: As a major tourist gateway, regulations are typically focused on maintaining the guest experience and safety standards, but are generally supportive of STRs.

Dayton, Ohio

Dayton has seen growing traveller demand, which drove an 8.1% increase in RevPAR (Revenue Per Available Rental) recently, signalling a strengthening market. This central Ohio city offers an affordable entry point ($227,000) with a developing STR performance (4.70% ROI, $3,030 monthly income), making it one to watch.

- Potential regulations: Similar to other Ohio cities, be prepared for local registration and permit requirements.

Wichita, Kansas

Wichita offers a steady and dependable opportunity. With an average property price of $296,000 and a 4.55% ROI, it appeals to investors looking for stability over high-risk growth. Its local economy and regional travel ensure a consistent base of guests, supporting a monthly income of $3,090.

- Potential regulations: Generally accommodating to STRs, but local business licences are required.

Shreveport, Louisiana

Shreveport is improving its key metrics year-on-year, showing a promising upward trajectory. Its popularity is supported by riverboat casinos and regional festivals, which create predictable demand spikes. With an average property price of $252,000, it presents an accessible investment opportunity, offering a solid 4.50% ROI and $3,160 in monthly income.

- Potential regulations: Hosts typically need to obtain a local short-term rental licence and adhere to zoning laws.

Sedona, Arizona

A premier resort destination, Sedona benefits from year-round demand driven by spiritual tourism, hiking, and stunning red rock scenery. Despite a high barrier to entry ($756,000), it commands premium rates and an outstanding 70.0% occupancy rate, providing a reliable monthly income of $6,630 and a 4.50% ROI.

- Potential regulations: Sedona is generally STR-friendly, but hosts must obtain a local STR licence and adhere to resort-area zoning.

Savannah, Georgia

Savannah’s charm, historic district, and southern hospitality ensure it remains a top destination. Its strong cultural and event-based demand leads to a solid 55.3% occupancy rate, with an average property price of $403,000, yielding a 4.20% ROI and $5,300 in monthly income.

- Potential regulations: Regulations in the historic district are particularly strict, often limiting the total number of licences available.

Miami, Florida

As an international gateway and a hub for world-class beaches and events, Miami’s STR scene is one of the strongest globally. Demand is high year-round, resulting in an exceptional average monthly income of $8,200 and a 4.00% ROI, despite the high property cost of around $567,000.

- Potential regulations: Miami’s regulations can be notoriously complex, varying greatly by neighbourhood and requiring careful adherence to city and county ordinances.

Nashville, Tennessee

Music City is a consistently strong, high-demand market, though its higher property prices ($504,000) make the ROI (3.50%) lower than the most affordable cities. The sheer volume of tourists pouring in for the music scene ensures a powerful, year-round tourism engine, making an average monthly income of $5,670 reliable.

- Potential regulations: Nashville has a history of regulating its STRs; strict permits and zoning limitations are in place, often restricting non-owner-occupied rentals.

Austin, Texas

Austin's blend of a booming tech sector, unique culture, and major events (like SXSW) keeps it a major draw. Despite high property prices ($630,000), the demand for STRs is strong, resulting in an average monthly income of $6,300. Investors here typically focus on long-term appreciation and solid returns rather than high initial yield (3.00% ROI).

- Potential regulations: Austin has complex and evolving regulations. Investors must strictly follow licensing requirements and occupancy limits.

Pro tip: discover what STR hosts must know to stay competitive in 2026.

Key takeaways

Investing in short-term rentals in 2026 is less about chasing fleeting trends and more about embracing operational excellence in markets where the numbers make sense. While high-yield, affordable markets like Rockford, Illinois, and Fairbanks, Alaska, offer excellent cash-flow opportunities, high-demand destinations like St. Petersburg, Florida, and Sedona, Arizona, offer a strong blend of high revenue and long-term appreciation.

However, regardless of which market you choose, one thing remains critical: the guest experience. As the market becomes more competitive, the easiest way to stand out, secure five-star reviews, and save yourself hours of administrative work is by providing crystal-clear information.

A Touch Stay digital guidebook can enhance your guests' experience and virtually eliminate those repeated ‘Where do I find the Wi-Fi code?’ or ‘How do I work the hot tub?’ questions. By proactively providing all the essential property, local and check-in information, you save time and elevate your brand instantly.

Whether you’re in a high-growth market like Crescent City or a high-income spot like Miami, a digital guidebook will ensure your guests feel looked after from the moment they book.

Ready to professionalise your operation and turbo-boost those five-star reviews?

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates