Are you looking to dive into the world of Airbnb and turn it into a lucrative income stream? Whether you dream of earning a bit of extra cash or building a full-blown business, Airbnb offers a wealth of opportunities for beginners. From hosting guests in your own home to exploring creative ways to profit without owning property, this guide covers it all.

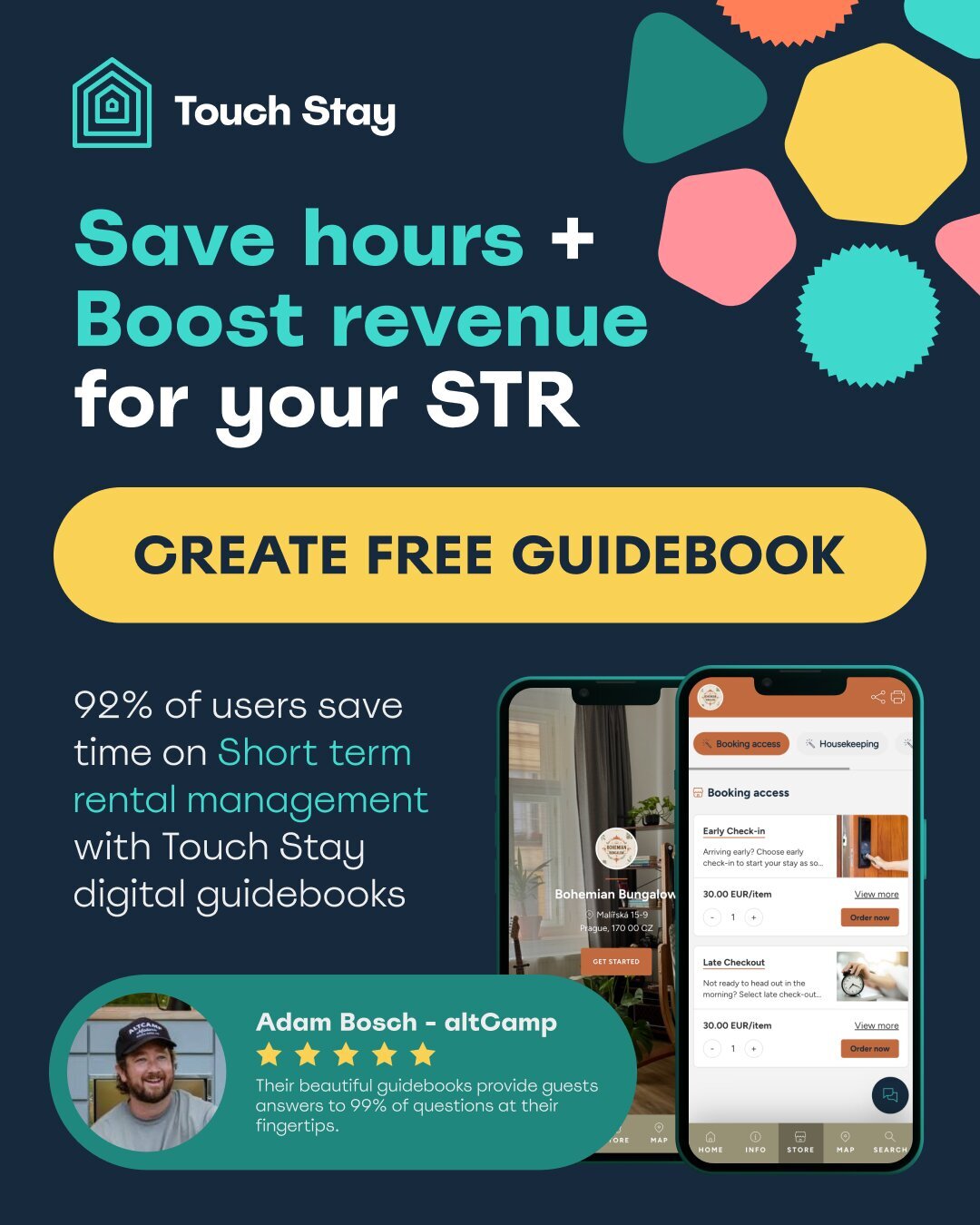

At Touch Stay, we’re passionate about helping short-term rental hosts save time and elevate guest experiences with our digital guidebooks—perfect for anyone looking to streamline their Airbnb venture. In this comprehensive guide, we’ll walk you through everything you need to know to make money with Airbnb, even if you’re starting from scratch:

- Can you make money with Airbnb?

- Do you have to own property to earn with Airbnb?

- How much money can you make on Airbnb?

- Average Airbnb earnings in the top-earning US states

- Why you should start an Airbnb business without owning property

- How to make money on Airbnb without owning property?

- Things to keep in mind when making money on Airbnb

- How to make money on Airbnb with your own property?

- FAQs

Whether you own a property or not, the opportunities are endless! Ready to simplify hosting? Try Touch Stay’s free trial.

Your AI Guidebook

Your guidebook is just one link away! Drop your Airbnb link to get started.

Can you make money with Airbnb?

The short answer is yes—Airbnb is a goldmine for those willing to put in the effort. For property owners, renting out a spare room, holiday home, or entire property can bring in steady cash flow. But here’s the exciting part: you don’t need to own a property to cash in. From managing listings for others to offering unique experiences, Airbnb opens doors for creative entrepreneurs. Whether you’re a homeowner or a savvy side-hustler, the platform’s flexibility makes it a fantastic way to earn money.

Pro tip: check out our comprehensive guide on how to implement pricing strategies to maximise your short-term rental revenue.

Do you have to own property to earn with Airbnb?

Owning property isn’t a prerequisite to making money on Airbnb—far from it! While traditional hosting involves listing your own space, there are plenty of alternative paths for non-owners. You could manage properties for hosts, offer cleaning services, or even invest in Airbnb stock. These options let you tap into the short-term rental market without the hefty upfront cost of buying a house.

- Alternative ways to profit without owning:

- Co-hosting or managing listings for busy property owners

- Providing services like photography, cleaning, or marketing for Airbnb hosts

- Hosting unique experiences, such as local tours or workshops

Pro tip: discover more about starting an Airbnb business without owning a property!

How much money can you make on Airbnb?

Wondering how much you could pocket from Airbnb? Earnings vary widely based on location, property type, and your business model. According to recent data, the average Airbnb host in the US earns around £11,000 annually (approximately $14,000 USD). However, top earners in tourist hotspots can rake in significantly more. Location is king—urban hubs and holiday destinations often yield higher returns than rural areas.

- Key factors affecting earnings:

- Location: cities like London or coastal towns typically command higher nightly rates

- Property type: entire homes earn more than private rooms or shared spaces

- Seasonality: peak travel seasons boost income, while off-peak times may dip

For a deeper dive into maximising your earnings, consider tools like Touch Stay’s digital guidebooks, which reduce guest queries and enhance satisfaction—potentially leading to better reviews and higher bookings. See how it works…

Average Airbnb earnings in the top-earning US states

If you’re curious about where Airbnb hosts thrive, let’s look at the numbers. Recent studies highlight the top-earning US states, where tourism and unique properties drive impressive incomes. Below is a table showcasing average annual earnings for hosts in these hotspots, based on data from Tipalti:

| State | Average annual earnings (USD) | Key factors |

| Hawaii | $73,247 | Tropical appeal, unique stays |

| Tennessee | $67,510 | Proximity to national parks |

| Arizona | $60,448 | Desert tourism, seasonal demand |

| Colorado | $58,108 | Ski resorts, outdoor activities |

| California | $54,461 | Urban hubs, coastal destinations |

These figures reflect gross revenue, so costs like maintenance and fees will reduce net profit. Still, they show the earning potential in high-demand areas!

Why you should start an Airbnb business without owning property

Starting an Airbnb business without owning property might sound unconventional, but it’s a smart move for beginners. It skips the massive investment of buying real estate while letting you test the waters. However, it’s not without its trade-offs. Let’s weigh the pros and cons.

- Pros:

- Lower startup costs—no mortgage or property taxes to worry about

- Flexibility to scale by taking on multiple clients or projects

- No long-term commitment to a single property

- Cons:

- Earnings may be lower than owning a high-performing rental

- Reliance on others’ properties can limit control

- Competition is fierce in some service-based niches

For more insights, check out our blog on Airbnb rental arbitrage - one of our most popular blogs!

How to make money on Airbnb without owning property?

You don’t need to own a home to profit from Airbnb—there are plenty of creative avenues to explore. Here’s an overview of 12 methods:

1. Co-hosting

Partner with property owners to manage their Airbnb listings. You handle booking, guest communication, and logistics for a fee or revenue share.

Real-world example: Seth Sutherland and his wife co-host Airbnb properties, managing bookings and guest communications for property owners. They earn up to 20% of the owner's revenue and spend about three hours a week managing five properties, making approximately $1,000 a month, peaking at $1,500 during the summer.

2. Property management

Take full control of a property’s operations—cleaning, pricing, and maintenance—for a steady income stream.

3. Hosting experiences

Offer local tours, cooking classes, or workshops through Airbnb Experiences. No property required—just your expertise!

Real-world example: Airbnb's official resource center features success stories of hospitality entrepreneurs who have grown their businesses by offering unique experiences. One such story is about a property manager in Colorado who manages more than 120 listings, showcasing the potential of hosting experiences without owning property.

4. Vacation rental franchise

Invest in a franchise model that manages multiple rentals, earning you a slice of the profits.

5. Photography

Snap stunning photos for Airbnb listings. Quality visuals boost bookings, and hosts are willing to pay for them.

6. Copywriting

Craft compelling listing descriptions to attract guests. A well-written listing can make all the difference.

7. Airbnb cleaning service

Provide professional cleaning between guest stays—a vital service in high demand.

Real-world example: Camilla Shipton, a 54-year-old mother from Kent, England, transformed her side hustle of cleaning rental properties into a successful business empire. She founded Keepers Cottages in 2013, which now manages 155 desirable rental homes across Kent, providing comprehensive management services, including cleaning, laundry, and maintenance.

8. Airbnb consultant

Advise hosts on optimising their listings, pricing, and guest experience for a consultancy fee.

9. Vacation rental marketer

Promote listings through social media, SEO, or ads to drive bookings for a commission.

10. Airbnb upsell service

Offer add-ons like airport transfers or welcome baskets, splitting profits with hosts.

11. Buy Airbnb stock

Invest in Airbnb’s publicly traded stock for long-term gains, though this isn’t hands-on income.

12. Renting a spare bedroom

If you rent your home, get landlord permission to sublet a room on Airbnb.

Things to keep in mind when making money on Airbnb

Success on Airbnb isn’t just about picking a method—it’s about navigating the finer details. Here are critical factors to consider.

Agreement and permission from landlords

If you’re renting, always secure written consent from your landlord before listing a space. Breaching your lease could lead to eviction.

Airbnb fees

Airbnb charges hosts a service fee (typically 3-5%) and guests a fee (up to 14.2%). Factor these into your pricing or budgeting.

Pro tip: learn more about Airbnb fees here.

Taxes and regulations

Short-term rental income is taxable, and local laws may restrict Airbnb activity. Research your area’s rules to stay compliant.

Safety and insurance

Protect yourself with Airbnb’s AirCover or third-party insurance. Safety checks—like smoke alarms—are non-negotiable.

How to make money on Airbnb with your own property?

Owning a property gives you full control over your Airbnb business. Here’s a concise step-by-step guide to get started:

- Research your market: analyse local demand, competition, and pricing

- Set up your space: furnish and style it for guests—think comfort and appeal

- Create a standout listing: use great photos and a detailed description

- Price competitively: adjust rates based on season and occupancy trends

- Streamline guest communication: use tools like Touch Stay’s digital guidebooks to reduce questions and boost satisfaction

- Maintain your property: keep it clean and fix issues promptly

Pro tip: for a deeper dive, read Touch Stay’s guide on how to start an Airbnb business without owning a property.

Create your own free trial guidebook in 60 seconds.

Your AI Guidebook

Your guidebook is just one link away! Drop your Airbnb link to get started.

Frequently Asked Questions

Got questions about making money with Airbnb? We’ve got answers! Below, we tackle the most common queries beginners have, from understanding passive income to navigating Airbnb’s rules. Let’s dive in.

Airbnb passive income refers to earnings from hosting that require little day-to-day effort once the setup is complete. Imagine listing your spare room or holiday home and letting bookings roll in with minimal intervention—sounds dreamy, right?

For many, this means outsourcing tasks like cleaning or guest communication to co-hosts or services. While no income is truly "passive" (there’s always some initial work!), tools like Touch Stay’s digital guidebooks can make it feel that way by cutting down on repetitive guest questions. It’s a popular goal for hosts aiming to earn extra cash without turning hosting into a full-time job.

Airbnb owners make money by renting out their properties—whether it’s a spare bedroom, an entire flat, or a quirky shepherd’s hut—to guests seeking short-term stays. They set a nightly rate based on local demand, property type, and seasonality, then pocket the revenue after Airbnb’s fees. For example, a cosy London flat might fetch £100 per night, while a Cornwall cottage could command £150 during summer.

Success hinges on great listings, stellar reviews, and keeping guests happy—something Touch Stay’s digital welcome books can help with by providing clear, instant info. It’s a hands-on way to turn property into profit!

Airbnb’s cut depends on who’s paying. Hosts typically pay a service fee of 3-5% per booking, deducted from their payout—lower if you opt for strict cancellation policies. Guests, meanwhile, face a fee of up to 14.2% of the booking subtotal, added at checkout. So, if a guest books a £100 night, the host might net £95-97, while the guest pays £114 or more.

These fees fund Airbnb’s platform, insurance, and support, but they’re worth factoring into your pricing strategy to ensure you still make money on Airbnb.

Airbnb’s primary revenue stream is the service fees it charges hosts and guests on every booking. Unlike hosts who earn from rental income, Airbnb itself doesn’t own properties—it’s a platform that thrives on facilitating transactions. In 2022, the company reported global revenues of $8.4 billion USD (about £6.6 billion), largely from these fees, according to its annual financial reports.

This model keeps Airbnb profitable while empowering hosts to make money with Airbnb—whether they own a property or not.

The 90-day rule is a regulation in some cities, like London, that limits how long you can rent out a property on Airbnb without a special permit. Specifically, it caps short-term lets (stays under 90 days) at 90 days per calendar year for an entire home. Introduced to balance housing supply and tourism, it means you can’t host full-time without jumping through extra hoops—like applying for planning permission.

Always check your local council’s rules, as breaching them could lead to fines and a dent in your Airbnb make money plans.

The most profitable dates for Airbnb hosts align with peak travel periods when demand—and prices—soar. Think summer months (June to August), major holidays like Christmas and New Year’s, and local events like festivals or sports tournaments. In the UK, coastal spots like Cornwall shine in summer, while city breaks in Edinburgh spike during the Fringe Festival.

Data from AirDNA suggests hosts can charge 20-50% more during these times. To maximise earnings, tweak your calendar early and use dynamic pricing tools—then let Touch Stay’s digital guidebooks handle the guest influx smoothly.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates