Are you a short-term rental host drowning in a sea of guest questions and frustrated by the ever-growing pile of tasks on your plate?

For many short-term rental hosts, property management seems like a magic solution. Professional property managers handle everything from guest communication and housekeeping to maintenance and repairs. But this convenience comes at a cost – property management fees. This blog post will break down everything you need to know about property management fees, from additional costs to how a digital guidebook can streamline your property management journey:

- Understanding property management fees

- Standard fee breakdown

- Additional charges and hidden costs

- Factors influencing overall costs

- How to choose the right property manager

- Tips to keep fees under control

By the end of this blog post, you'll be equipped to make informed decisions about property management and ensure you're getting the best possible service for your hard-earned cash. Let's dive in!

Understanding property management fees

Before we delve into the nitty-gritty of property management fees, let's establish a clear understanding of what they are and why they matter for short-term rental hosts like yourself.

Still unclear on how vacation rental property management works? Check out this blog that breaks the whole process down for you.

What are property management fees?

Property management fees are the fees you pay a property management company to handle the day-to-day operations of your short-term rental property. These fees typically cover a wide range of services, including:

- Guest communication and screening

- Booking management

- Rent collection

- Housekeeping and cleaning

- Maintenance and repairs

- Guest amenities and supplies

- Legal compliance

- Financial reporting

How much do property managers charge?

Property management fees can vary widely depending on several factors, but they typically range from 20% to 50% of your gross rental income. This means that for every £1,000 you earn in rent, you can expect to pay your property manager between £200 and £500.

Why they matter for owners

Property management fees can be a significant expense, but they can also be a worthwhile investment. Here's why:

- Save time and reduce stress: property management companies take the burden of managing your short-term rental off your shoulders, freeing up your time and energy to focus on other things.

- Increased revenue: experienced property managers can help you optimise your pricing strategy, maximise occupancy rates, and generate more revenue from your rental property.

- Improved guest experience: property managers can ensure your guests have a smooth and enjoyable stay, leading to better reviews and repeat bookings.

- Reduced risk and liability: property managers can handle legal compliance issues, maintenance emergencies, and guest disputes, minimising your risk and liability.

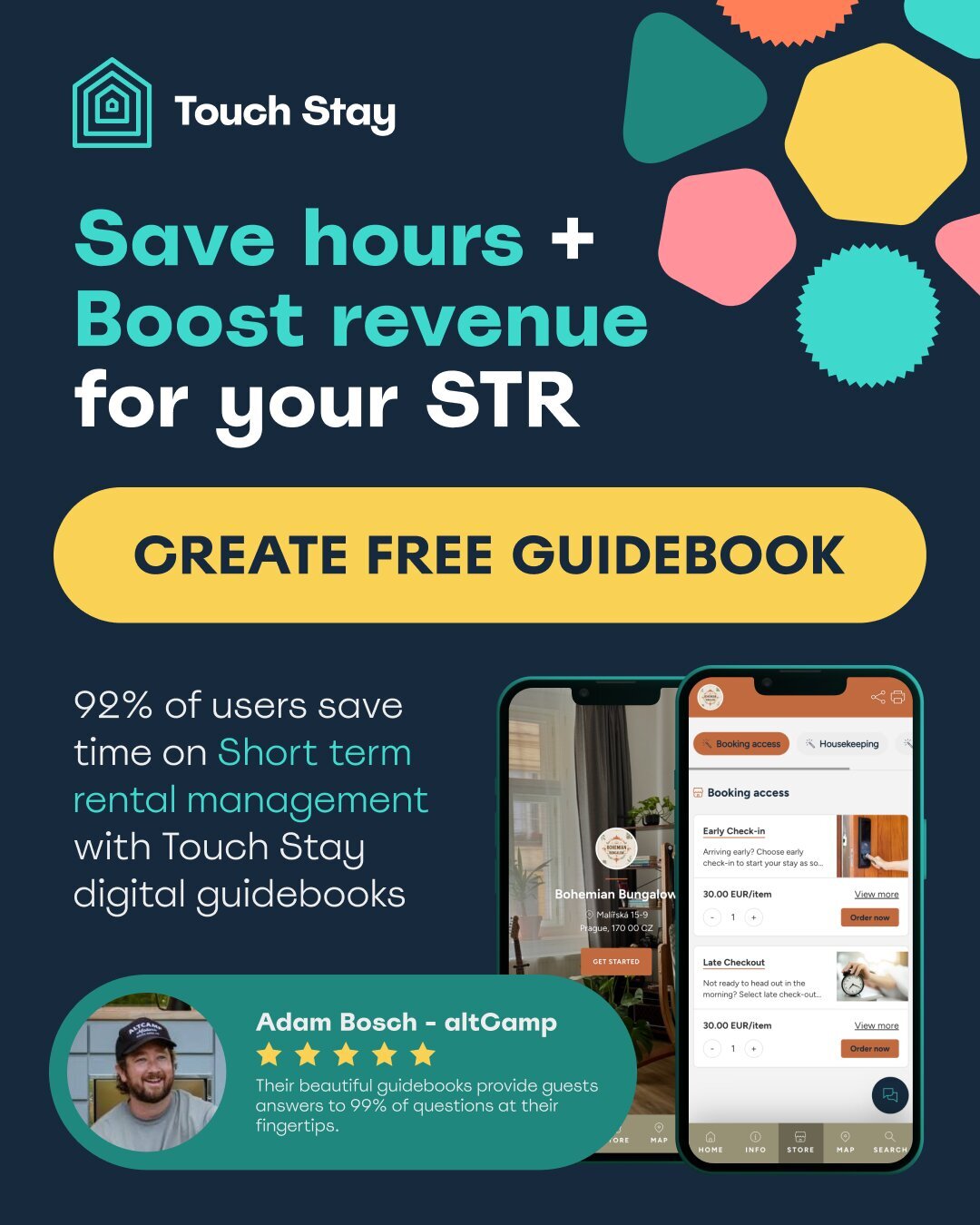

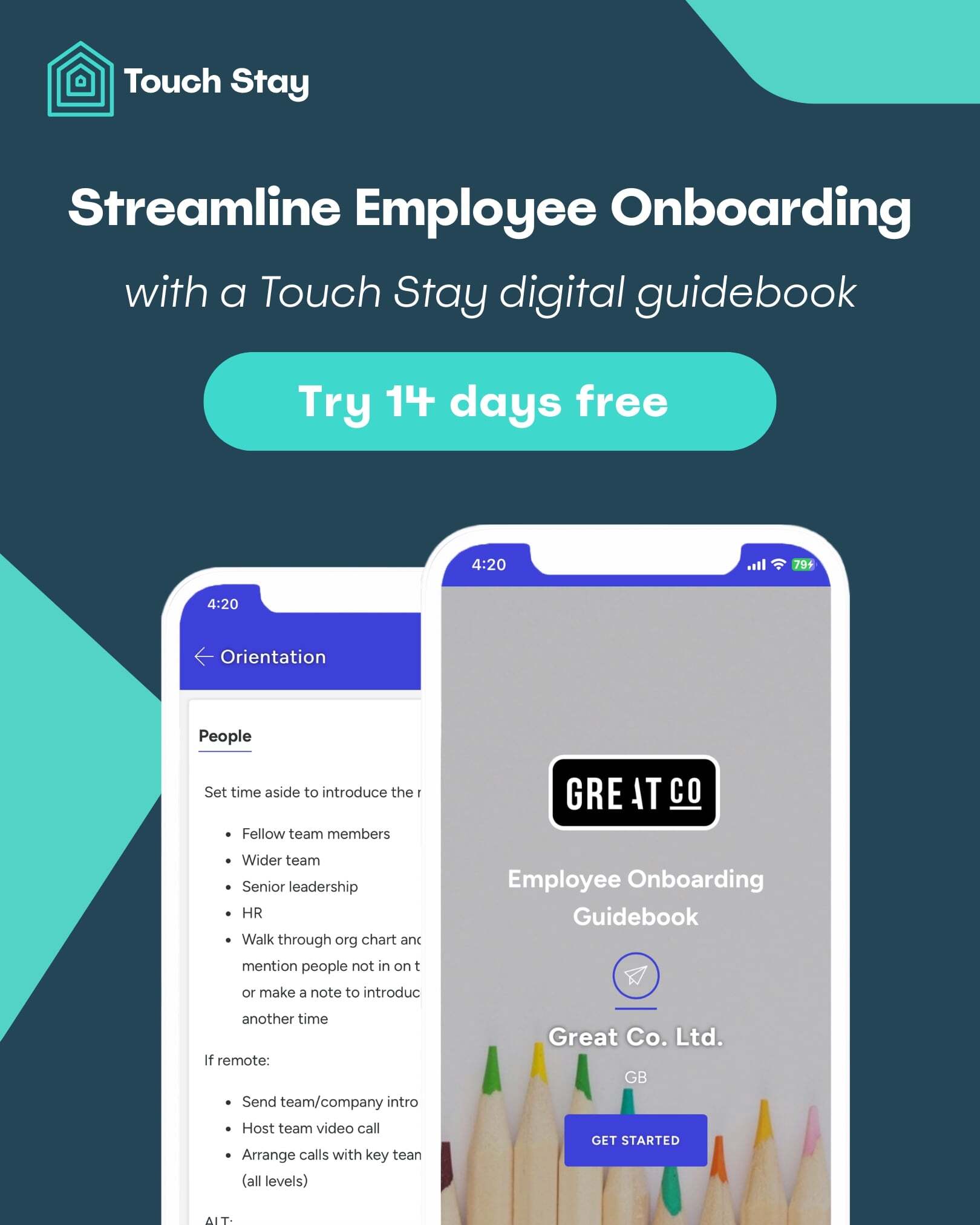

Feeling overwhelmed by the complexities of short-term rental management? Sign up for a 14-day free trial of Touch Stay and discover how a digital guidebook designed especially for property managers can help streamline your operations and free up your time!

Now that we understand the value proposition of property management fees, let's break down the standard fee structure.

Standard fee breakdown

| Fee type | Description | Typical cost |

| Monthly management fee |

|

20-40% of monthly rent |

| Leasing/Tenant placement fee |

|

Either:

|

| Maintenance & repair costs |

|

Varies by company:

|

Property management fees typically consist of a combination of the following:

Monthly management fee

The monthly management fee is a fixed percentage (typically 20-40%) of your gross rental income. This fee covers the ongoing costs of managing your property, such as staff salaries, marketing expenses, and office overhead.

Leasing or tenant placement fee

Some property management companies charge a separate fee for leasing your property or finding a tenant. This fee can be a flat fee or a percentage of the first month's rent.

Maintenance and repair costs

While some property management companies include basic maintenance and repairs in their monthly fee, others charge separately for these services. Be sure to understand how your chosen property management company handles maintenance and repair costs before signing a contract.

Discover more about Touch Stay’s digital guidebooks designed especially for property management.

Additional charges and hidden costs

In addition to the standard fees mentioned above, there may be other charges to consider:

Eviction and legal fees

If you encounter a problem tenant who needs to be evicted, your property manager may charge you a fee to handle the eviction process. This could include legal fees, court costs, and other associated expenses.

Advertising and marketing expenses

Some property management companies charge additional fees for marketing your property. This could include listing fees on short-term rental platforms, photography costs, or social media advertising expenses.

Renewal fees

Some property managers may charge a fee to renew your lease or property management agreement.

Pro tip: it's crucial to carefully review the property management agreement before signing to understand all the potential costs involved.

Factors influencing overall costs

Several factors can significantly influence the overall cost of property management fees:

Property type and location

The type of property you own (e.g., single-family home, apartment, vacation rental) and its location can impact property management fees.

- High-demand locations: properties in popular tourist destinations or areas with high demand for rentals may attract higher property management fees due to increased competition and higher service expectations.

- Luxury properties: managing luxury properties often requires more specialised services and higher-quality amenities, which can translate to higher property management fees.

Level of service required

The level of service you require from your property manager will directly impact the cost.

- Full-service management: full-service management includes a wide range of services, such as guest screening, booking management, housekeeping, maintenance, and 24/7 emergency support. This level of service typically comes with higher fees.

- Limited-service management: limited-service management may only include a few essential services, such as guest screening and rent collection. This option usually has lower fees but also offers less support.

Management company’s experience

The experience and reputation of the property management company can also influence fees.

- Experienced companies: Experienced and reputable companies with a proven track record may charge higher fees due to their expertise and established network.

- New or smaller companies: New or smaller companies may offer more competitive pricing to attract clients, but they may not have the same level of experience or resources as larger companies.

Ready to explore more cost-effective ways to manage your short-term rental? Discover how Touch Stay's digital guidebooks can help you reduce reliance on property managers while enhancing the guest experience.

How to choose the right property manager

Choosing the right property manager is crucial to ensure you get the best possible service for your investment. Here are some key considerations:

Setting clear expectations

Before you start interviewing property managers, clearly define your needs and expectations.

- What services are essential to you?

- What is your budget?

- What are your goals for your short-term rental property?

Comparing fee structures

Carefully compare the fee structures of different property management companies.

- Look beyond the initial quote: consider all potential costs, including any hidden fees or additional charges.

- Request detailed fee breakdowns: ensure you understand exactly what each fee covers.

Evaluating reputation and references

Research the reputation of each property management company you are considering.

- Read online reviews: see what other property owners have to say about their experiences.

- Check online ratings and industry awards: look for companies with strong reputations and industry recognition.

- Request references: contact other property owners who have used the services of the property management company.

Discover the top tools for landlords and property managers with our list of the best property management software.

Tips to keep fees under control

While property management fees can be a significant expense, there are several strategies to help you keep costs under control:

- Explore alternative options: consider self-managing your property or using a hybrid approach that combines self-management with limited-service property management.

- Negotiate fees: don't be afraid to negotiate fees with potential property managers, especially if you have multiple properties or are willing to sign a long-term contract.

- Maximise occupancy rates: higher occupancy rates translate to higher revenue, which can offset the impact of property management fees.

- Optimise your pricing strategy: use dynamic pricing tools to adjust your rental rates based on demand and seasonality.

- Improve operational efficiency: streamline your operations by implementing efficient systems and processes, such as using digital guidebooks to communicate with guests and provide them with essential information.

By carefully considering these factors and implementing these tips, you can choose the right property manager and manage your costs effectively.

Final thoughts

Property management fees can be a significant expense for short-term rental hosts. However, by understanding the factors that influence these fees, choosing the right property manager, and implementing cost-saving strategies, you can ensure you're getting the best possible value for your investment.

Remember, effective property management is not just about minimising costs; it's about finding the right balance between cost and the value of the services provided.

Ready to take control of your short-term rental management and reduce your reliance on expensive property managers?

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates