Quick answer (TL;DR)

The debate of Airbnb vs. renting is not about which is inherently better, but which is a better fit for you. Long-term renting offers a proven path to stable, passive income and peace of mind. Short-term renting offers the potential for significantly greater returns, but demands that you run a dynamic, highly active hospitality business, navigating complex regulatory landscapes and managing constant guest turnover.

If you choose the demanding but lucrative path of short-term rental, remember that efficiency is the key to profit. Reducing the time you spend answering the same questions repeatedly is the fastest way to improve your bottom line and your sanity.

A digital guidebook is an essential investment for any host committed to providing a professional, low-effort guest experience.

The rise of the sharing economy has fundamentally reshaped how property owners approach investment. For decades, the choice was straightforward: sell the property or become a traditional landlord.

Today, a third, highly lucrative option exists: the short-term rental (STR) market, popularised globally by platforms like Airbnb. This presents a critical dilemma for any property investor or homeowner with a spare flat or house: do you opt for the predictable, low-maintenance income of a traditional long-term tenancy, or chase the higher, yet more volatile, earnings of an Airbnb host?

We will break down the crucial differences across several key areas:

- Airbnb vs. short-term rental definitions

- Income potential and volatility

- Costs & operational differences

- The management workload and guest experience

- Legal, tax, and regulatory requirements

- Major risks and challenges involved

- Pros & cons summary

- FAQ's

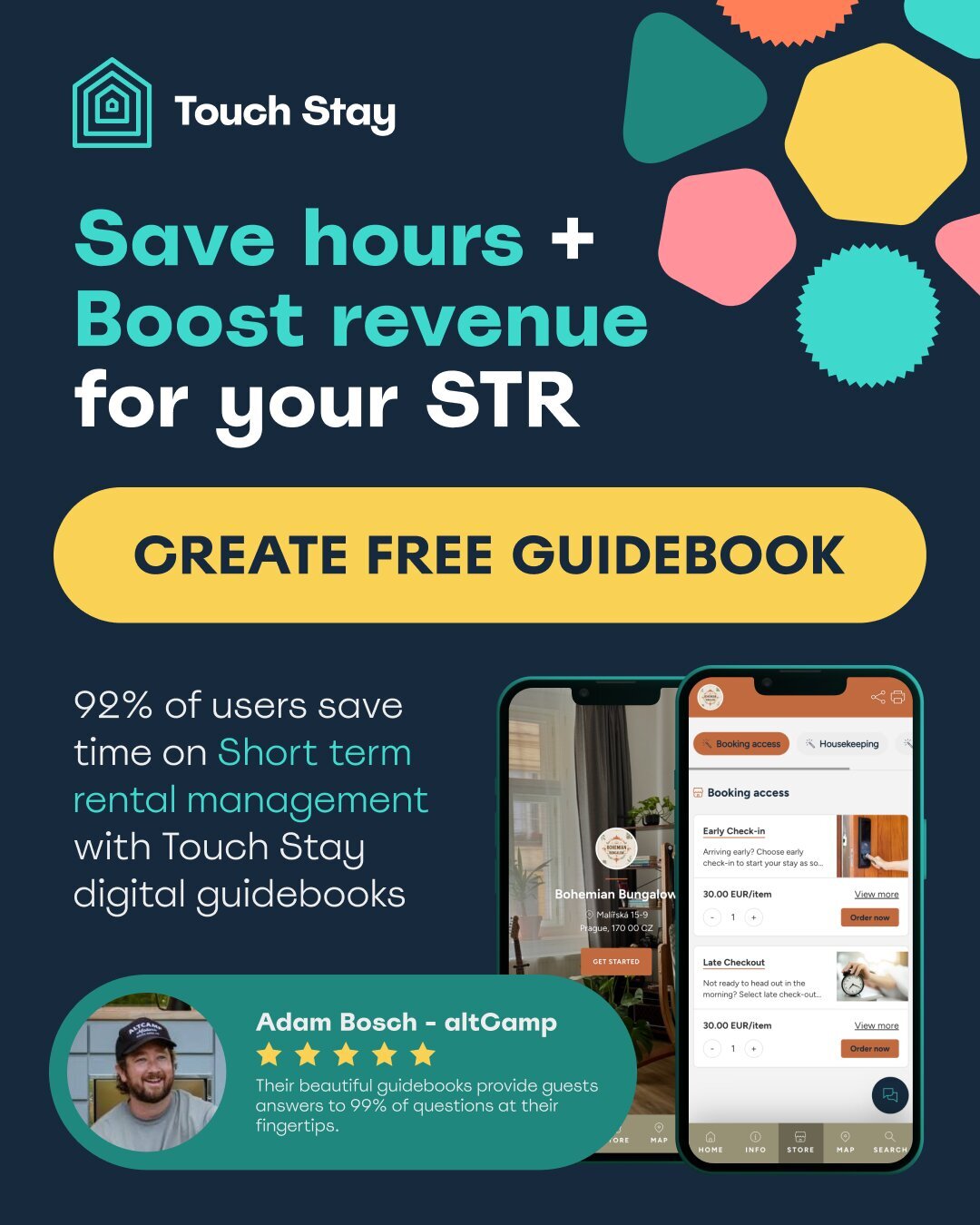

92% of Touch Stay users save time with a digital guidebook! Join them today

Airbnb vs. short-term rental

Before diving into the financial comparison, it’s important to clarify the terminology often used interchangeably in the property world. While the terms are related, they are not strictly the same, particularly when discussing the legal and practical implications of property investment.

Definitions - Airbnb vs. short-term rental (STR)

A short-term rental (STR) is the broad category of letting a property for short, fixed periods, typically under 30 or 90 days. This category includes everything from holiday lets to corporate accommodation. STRs are typically fully furnished and are rented out on a nightly or weekly basis.

Airbnb is simply one of the most prominent platforms, or online travel agencies (OTAs), that facilitates the booking of short-term rentals. It is a marketplace, not the strategy itself. When we refer to ‘Airbnb’ in this article, we are referring to the general practice of operating a short-term rental business model through platforms like Airbnb, Vrbo, or Booking.com.

Traditional long-term renting

Traditional long-term renting involves entering into a fixed-term tenancy agreement with a tenant, usually for a minimum duration of six or twelve months. The property may be furnished or unfurnished. The landlord-tenant relationship is governed by specific, often strict, national and local tenancy laws. This model is designed for stability and consistent cash flow.

Key differences in lease duration

The fundamental difference between the two models is the lease duration.

In a traditional long-term arrangement, the property is occupied by the same tenant for an extended period. This provides stability, minimises the administrative burden of checking guests in and out, and ensures a reliable monthly income stream.

In the STR model, the duration can range from a single night to a few weeks. This constant turnover is the source of both the potential for higher revenue (due to nightly pricing) and the higher operational demands (due to frequent cleaning, maintenance and communication). The landlord is operating a business that provides accommodation, rather than simply leasing a dwelling. This distinction is crucial for regulatory and tax purposes.

Income potential

When it comes to property investment, the core question is always: where is the maximum return? The answer here is complex, as higher potential revenue often comes with higher inherent risk.

Nightly rates vs. fixed monthly rent

The primary appeal of the STR model is the ability to charge significantly higher nightly rates than the equivalent pro-rata monthly rate for a long-term rental. A property that rents for £1,500 per month long-term might earn £100 per night as an STR. If fully booked, that’s £3,000 in gross revenue – double the long-term rent potential.

Conversely, fixed monthly rent offers unparalleled financial stability. The landlord knows exactly how much income they will receive on the first of every month for the duration of the tenancy agreement, making budgeting and mortgage payments simple and stress-free.

Want to see the real numbers for your property? Use our free Airbnb pricing calculator to estimate your potential STR income vs. long-term rental earnings, factoring in occupancy rates, cleaning costs, and seasonality.

Occupancy rates and vacancy risk

The financial viability of a short-term rental hinges entirely on maintaining high occupancy rates. The moment occupancy dips, the STR’s earnings potential quickly erodes, often falling below that of a stable long-term let. An STR with 50% occupancy in a slow month may struggle to cover costs, whereas a long-term let offers 100% occupancy assurance for the period of the lease.

Vacancy risk in long-term renting is generally lower and less frequent. When a tenant moves out, the vacancy is typically a matter of a few weeks (for re-letting and referencing) every year or two, not a rolling weekly concern.

Seasonality impact on Airbnb

For STRs, seasonality is the defining factor for cash flow. Coastal towns or city centres catering to tourism will experience peak seasons (summer, festive periods, major events, etc.) where rates skyrocket and occupancy is near 100%. They will also face trough seasons (mid-winter) where rates drop and long void periods become common.

Long-term renting is largely immune to this volatility. While demand for rentals might slightly fluctuate, a sitting tenant pays the same rent regardless of the season, ensuring reliable, year-round income.

Predictability of cash flow

The predictability of cash flow is the key differentiator for investors.

- STR: High potential, low predictability. Revenue can vary wildly month-to-month based on marketing, pricing strategy, local events and weather. This model is generally better suited for investors with significant cash reserves who can absorb lean months.

- Long-term: Low volatility, high predictability. Revenue is consistent and reliable, making it easier to manage mortgages, maintenance budgets and other outgoings. This is ideal for investors prioritising consistent yield and lower financial stress.

Costs & operational differences

While the long-term landlord usually covers structural repairs and annual maintenance, the STR host is essentially running a micro-hotel, incurring operational expenses that a traditional landlord would never face.

Upfront furnishing and setup

A long-term rental can often be let unfurnished or with minimal basic appliances. An STR, however, must be fully furnished, equipped and styled to a high standard to attract premium nightly rates. The upfront furnishing and setup costs for an STR are significant, covering everything from beds, kitchenware and high-quality linen to entertainment systems and aesthetic décor. These initial investments must be factored into the return on investment (ROI) calculation. They also require more frequent replacement due to higher usage.

Cleaning and turnover costs

The cleaning and turnover costs are the largest single operational difference. Each time a short-term guest checks out, the property requires professional cleaning, replenishment of consumables (toiletries, coffee, etc.), and fresh linen/towel service. This is a perpetual cost and logistical challenge.

💡 Pro tip: check out our ultimate guide to finding reliable and affordable cleaners

In a long-term rental, cleaning is the tenant's responsibility throughout the tenancy, and the landlord only incurs a deep cleaning cost when a tenant moves out, perhaps once every few years.

Utilities and subscriptions

In an STR, the host is almost always responsible for all utilities and subscriptions (gas, electricity, water, high-speed Wi-Fi, television licences, streaming services). These costs are absorbed by the host and can fluctuate significantly, especially with energy price changes.

In a long-term let, the tenant is typically responsible for setting up and paying for all utilities and council tax, dramatically reducing the landlord's monthly outgoings.

Property management fees

Both strategies can utilise property managers, but the fees and services differ greatly.

- Long-term management: Typically 8-15% of the monthly rent. Services include tenant finding, rent collection, and maintenance coordination.

- STR management: Can range from 15-40% of the gross revenue. This higher percentage reflects the 24/7 nature of the work, including dynamic pricing, listing optimisation, guest communication, managing cleaning crews, and handling emergency maintenance at all hours.

Managing multiple properties?

92% of Touch Stay users say their digital guidebooks save them time!

Start reclaiming your precious time today and discover how much you and your team can get done…

Management workload

This is where the distinction between ‘active’ and ‘passive’ income becomes most stark.

Active hosting vs. passive landlording

Traditional landlording (long-term renting) is a relatively passive endeavour. Once a reliable tenant is in place, the workload consists primarily of collecting rent and addressing essential maintenance issues when they arise. The job is administrative and reactive.

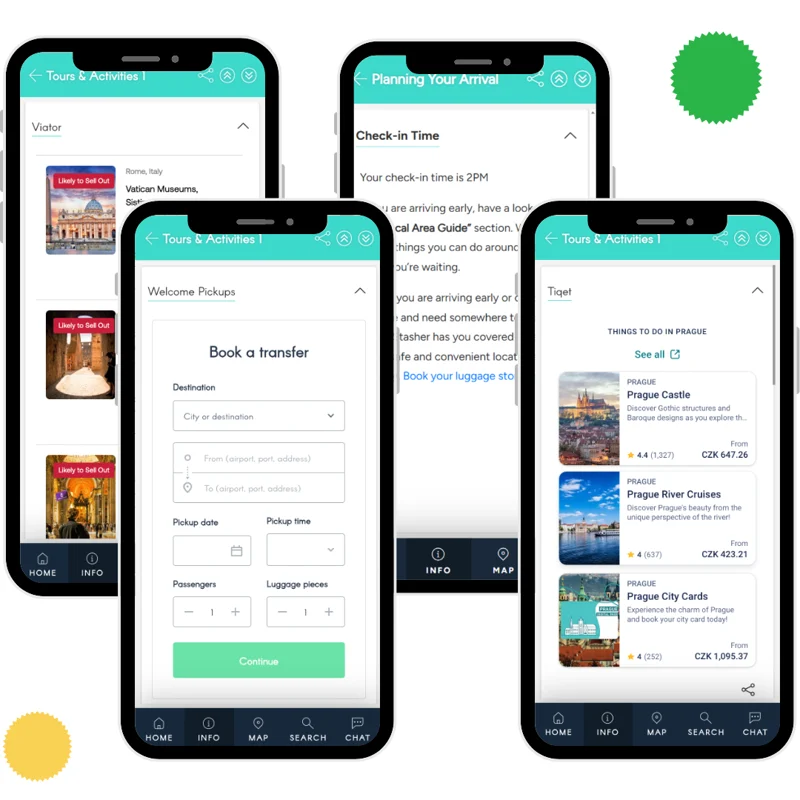

Short-term hosting is an active small business. It requires constant attention: updating prices daily, responding to booking enquiries, coordinating maintenance around check-ins, managing supplies, and ensuring the property is perfectly presented for every single arrival. The host is fundamentally a hospitality provider.

Guest communication intensity

The sheer volume and intensity of guest communication in the STR model can be overwhelming. You are answering queries about local attractions, checking in late arrivals, handling forgotten keys, and managing complaints instantly, sometimes multiple times a day. Guests expect immediate, hotel-like service.

Long-term landlords communicate infrequently, usually only for essential matters like lease renewals, rent reviews, or maintenance issues.

💡 Pro tip: discover the art of effective guest communication

Guest experience

The success of an STR is built entirely on the guest experience. Poor reviews can instantly destroy a listing’s reputation and profitability, requiring constant, meticulous attention to detail. This means providing a stellar stay, which includes clear, accessible, and high-quality information about the property and the local area.

This is where tools designed for guest communication and information, such as digital guidebooks, become invaluable. Touch Stay helps professional hosts and property managers reduce their workload significantly by anticipating and answering up to 90% of common guest questions before they are asked, all while elevating the guest experience through slick, mobile-friendly digital guides.

If you’re a short-term rental host looking to drastically cut down on repetitive guest questions, find out how a digital guidebook can revolutionise your operation. You can start your journey to a more efficient hosting experience today:

Legal & regulatory landscape

The legal frameworks governing the two strategies are vastly different, with the STR market facing far greater regulatory scrutiny and change.

STR licensing and permits

Many cities and local councils across the UK and globally are introducing stringent STR licensing and permit requirements to control housing supply and tourism impact. These often involve complex registration processes, annual fees, adherence to specific safety standards (e.g., fire safety), and, increasingly, limitations on the total number of days a property can be let per year (e.g., the 90-day rule in London). Non-compliance can result in heavy fines.

Landlord-tenant laws

Traditional landlord-tenant laws are mature and well-defined, offering clear processes for rent collection, deposit protection, and, if necessary, eviction. While they heavily favour the tenant in many jurisdictions, the legal framework is established and predictable, offering the landlord security through a formal contract.

HOA restrictions

If the property is part of a block of flats or an estate managed by a Homeowners’ Association (HOA), there may be strict rules in place. Many HOAs expressly forbid or severely restrict STR activity to maintain security and quality of life for long-term residents. Long-term rentals, however, are rarely prohibited.

Tax implications

The tax implications are significantly different. Long-term letting typically falls under standard income tax rules. Short-term renting, when run as a business (a Furnished Holiday Letting in the UK, for instance), can qualify for certain tax reliefs and potentially lower Capital Gains Tax (CGT) upon sale. However, the accounting is far more complicated and requires professional advice.

Risks & challenges

Every investment carries risk, but the nature of the risk differs fundamentally between the two models.

Vacancy and income volatility

The single biggest risk for STRs is vacancy and income volatility. A sustained drop in tourism, a local economic downturn, or a new competitor opening nearby can wipe out months of projected profits almost overnight. The long-term rental market offers income stability, but the risk shifts to tenant-related issues.

Wear and tear

Constant turnover in an STR can lead to faster wear and tear on furnishings and appliances. 50 different guests per year will inevitably result in more accidental damage, requiring faster refurbishment cycles and higher ongoing repair budgets than a single long-term tenant.

Regulatory changes

The regulatory changes impacting STRs are the most unpredictable and severe challenge. A council can vote to ban or heavily restrict STRs with little notice, forcing hosts to suddenly convert their properties to long-term lets, often at a loss on their investment.

Eviction vs. bad reviews

The process for removing a disruptive long-term tenant (eviction) is lengthy, expensive, and legally cumbersome, taking months in court.

The host’s equivalent nightmare is receiving bad reviews. A single, unfair 1-star review can drastically reduce bookings and income for months, or even lead to the suspension of the listing. While less legally complex, it is commercially lethal and requires constant reputation management.

Ready to take control of your property business and reduce your exposure to poor guest reviews caused by lack of information? Discover how Touch Stay can help you provide a 5-star digital welcome, saving you time and stress.

Pros & cons summary

To bring the analysis together, here is a quick summary of the comparative strengths and weaknesses of each property strategy.

Airbnb pros and cons

| Pros | Cons |

| High Income Potential: Potential for significantly higher gross revenue than long-term rent | High Volatility: Income is seasonal and unpredictable; cash flow is not guaranteed |

| Flexibility & Access: Host can block out dates for personal use or easily sell the property without a tenant | High Workload: Requires active management, constant communication, cleaning and maintenance |

| Tax Advantages: Potential tax benefits as a qualifying business (check local rules) | High Setup Costs: requires full, high-quality furnishing and frequent replacement of goods |

Long-term renting pros and cons

| Pros | Cons |

| Stability & Predictability: Guaranteed monthly income stream for the lease duration | Lower Yiels: Income potential is capped at the market rate; no dynamic pricing ability |

| Low Workload: Primarily passive income; less hands-on management and no guest turnover | Low Flexibility: Difficult to sell quickly or use the property when a tenant is in place |

| Lower Operational Costs: Tenant pays for utilities and council tax | Eviction Risk: Removing a problem tenant can be a very long and costly legal process |

How to choose based on your goals

The choice between a short-term strategy like Airbnb and traditional long-term renting ultimately depends on your personal financial goals, your capacity for hands-on work and the characteristics of your local market.

Max revenue vs. stability

If your primary goal is maximum revenue and you are an experienced investor with a healthy risk appetite, the STR model is likely the winner. You must be prepared to weather months of low occupancy and high workload for the possibility of significant profit during peak seasons.

If your priority is stability, reliable cash flow and a low-stress, passive investment, long-term renting is the clear choice. It provides predictable income perfect for covering mortgage costs and generating a steady yield.

Time commitment availability

Be ruthlessly honest about your time commitment availability. If you work full-time or are managing multiple properties, becoming an active STR host will quickly lead to burnout. Unless you are prepared to hand over 30-40% of your revenue to a full-service property manager, a long-term let offers the peace of mind of minimal administrative effort.

Using a digital guidebook to reduce repeated communication will save hours every week.

Local market demand

Finally, research your local market demand. Is your property near a major tourist attraction, a business district, or a major transport link? These are ideal conditions for STR success. If your property is in a quiet, residential area with stable local employment, it is likely better suited for a long-term family tenant.

Frequently asked questions

We often encounter the same core questions from investors weighing up the two strategies.

While the average property can generate a higher gross income through STRs than long-term renting, the long-term model often provides a higher net yield once all the active costs of STR management (cleaning, utilities, marketing, repairs and management fees) are factored in. The STR model typically only yields significantly more in high-demand, peak-season locations.

Yes, absolutely. Standard home insurance or traditional landlord insurance will not cover commercial STR activity. You must secure specialist short-term rental or holiday let insurance, which covers the increased risks of liability, malicious damage by guests and loss of revenue due to guest-related issues. This is a non-negotiable cost.

Yes, but it requires careful planning. You cannot legally ask a sitting long-term tenant to leave simply to convert to an STR. You must wait until the end of their fixed term or tenancy agreement. Switching from STR back to long-term is much simpler.

Seasonality creates periods of ‘feast or famine’. Hosts must use the high profits of the peak season to cover the low-to-no profit of the off-season. Effective hosts use shoulder seasons to offer mid-term corporate or digital nomad lets to maintain a base level of income, which requires being flexible with pricing and minimum stay durations.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates