Quick Answer (TL;DR)

Rental property deductions let you subtract legitimate business expenses from your rental income, so you are taxed only on profit, not revenue. Track and claim costs like mortgage interest, repairs, cleaning, insurance, management fees, utilities, software, and depreciation. Keep clear records, separate current vs capital expenses, and use simple systems and tools to stay organised, reduce admin, and maximise your after-tax rental profits.

Being a landlord or a short-term rental host is a complex business where meticulous management is key. The good news is that the costs incurred while operating your rental property are often eligible for tax deductions, turning operational expenses into crucial savings.

Navigating the world of tax requires organisation and efficiency. Every pound spent on management, guest communication, or property upkeep is a potential deduction that can boost your bottom line.

This comprehensive guide breaks down the essential information and provides a checklist of the 25 most critical rental property deductions. We’ll ensure you’re equipped to claim every eligible expense and run the most profitable property business possible.

Before we dive in, here’s what we will cover:

- What are rental property deductions?

- How do rental property deductions work?

- Rental property deductions checklist

- The power of preparation

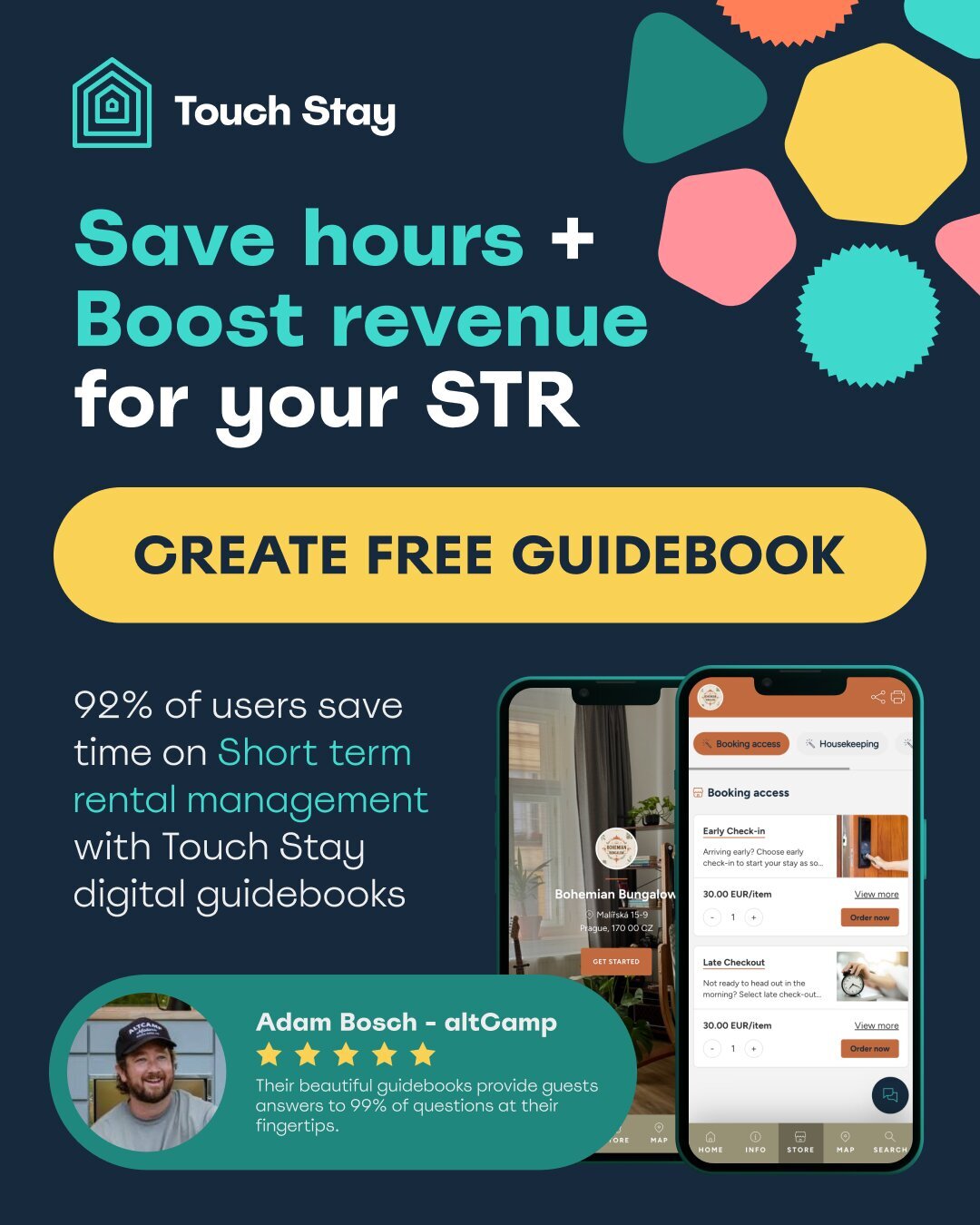

Want to save hours of admin time and eliminate up to 80% of repetitive guest questions?

What are rental property deductions?

A rental property deduction is an eligible expense you can subtract from your gross rental income. You are only taxed on the profit you make, not on the total amount of rent you collect. Therefore, legitimate costs incurred to earn that rental income are deductible.

For a cost to be deductible, it generally must be:

- Ordinary: Common and accepted in the property rental industry

- Necessary: Appropriate and helpful for running your business

- Crucially: Used ‘wholly and exclusively’ for your rental activity

Understanding these deductions is key to operating within the legal framework and avoiding overpaying your tax bill.

How do rental property deductions work?

Deductions reduce your taxable income. When filing your tax return, you subtract all eligible business expenses from your total rental income. The resulting figure is your net rental profit, which is the amount upon which your income tax is calculated.

Some deductions are fully expensed immediately (current expenses), while others (capital expenses) are recovered over several years through depreciation. Proper classification is vital for compliance.

A quick look at how deductions work

Deductions generally fall into two main categories:

- Current expenses: Routine costs like utility bills, insurance and maintenance. They are deducted in full in the same tax year that they are paid

- Capital expenses: Significant costs that add value or prolong the property's life (e.g., a new roof). These must be capitalised and recovered through depreciation over time

Accurate record-keeping is essential. You must retain:

- All receipts

- Invoices

- Bank statements related to your property expenses

If you cannot prove an expense, you cannot claim the deduction.

Rental property deductions checklist

Here is a comprehensive checklist of 25 key expenses you should be tracking and claiming for your rental business.

- Advertising and marketing

- Closing costs

- Continuing education

- Depreciation - building

- Dues and subscriptions

- Home office

- Insurance

- Mortgage interest

- Landscaping

- Leasing

- Licenses

- Maintenance

- Office supplies

- Property management

- Property tax

- Repairs

- Tenant screening

- Utilities

- Security systems and alarm monitoring fees

- Cleaning and janitorial services

- Legal and professional fees

- Accounting and bookkeeping services

- Travel expenses related to property management

- Pest control

- Supplies and small equipment purchases

1. Advertising and marketing

Any money spent to attract and vet a tenant or guest is deductible. This includes:

- Listing fees on property portals (Airbnb, Rightmove, etc.)

- Professional photography

- Paid social media campaigns or 'To Let' signs

A high-quality digital guidebook is a powerful marketing tool. A subscription to a service like Touch Stay can typically be counted as a deductible expense under marketing or operational costs, helping you secure bookings at a better rate.

💡 Pro tip: Learn how to promote your Airbnb business with our Airbnb marketing strategy

2. Closing costs

Expenses associated with the property's purchase, such as loan origination fees (points) or appraisal fees, may need to be amortised or added to the property's cost basis and recovered through depreciation. Costs like attorney’s fees and stamp duty are often included in your property’s basis. Always consult a financial advisor for proper classification.

3. Continuing education

The cost of improving your property management knowledge is deductible. This includes:

- Fees for online courses or investment seminars

- Subscriptions to industry magazines

The education must directly relate to improving your skills as a landlord.

4. Depreciation - building

Depreciation is a non-cash deduction that recovers the cost of the property (excluding the land) over time, recognising its wear and tear. This allows you to deduct a portion of the cost each year for a set number of years (e.g., 27.5 years for residential property), significantly lowering your taxable income.

5. Dues and subscriptions

Any membership or subscription that helps you manage your rental business effectively is deductible. This covers:

- Fees for landlord associations or trade organisations

- Software subscriptions essential for running your business, such as accounting software or your digital guidebook subscription

6. Home office

If you manage your rental business from your home, you can deduct a portion of your home-related expenses (like mortgage interest, insurance, and utilities). The space must be used regularly and exclusively as your principal place of business.

Premiums paid for any insurance related to your rental activity are fully deductible, including:

- Fire, theft, flood and other casualty insurance

- Landlord liability insurance

- Coverage for lost rents resulting from unexpected property damage

8. Mortgage interest

The interest paid on the mortgage used to acquire or improve the rental property is typically the largest single deduction. Use the official annual statement from your mortgage lender to track this amount accurately.

9. Landscaping

Expenses for maintaining the grounds and curb appeal are deductible current expenses. This includes:

- Lawn care and gardening services

- Tree trimming and purchasing replacement plants

Regular upkeep is deductible, while significant enhancements may be capital expenses.

10. Leasing

The costs associated with drafting and managing tenancy agreements are deductible. This includes:

- Fees paid to a solicitor or property lawyer to create or review a lease

- Costs for professional document signing services or standardised forms

11. Licenses

Fees associated with obtaining and renewing necessary licences or permits to operate your rental property (especially for HMOs or short-term rentals) are fully deductible as ordinary and necessary business expenses.

12. Maintenance

Maintenance restores an asset to its previous state (e.g., fixing a faulty tap, servicing the boiler) and is fully deductible in the year incurred. It is crucial to distinguish maintenance (deductible) from capital improvements (depreciable).

13. Office supplies

Any supplies you use specifically for your rental business can be deducted, including:

- Paper, ink cartridges and postage

- Filing cabinets and notebooks

- Rental costs for necessary office equipment

14. Property management

The fees you pay to a professional property management company to handle day-to-day operations are fully deductible.

If you are looking for ways to streamline operations without the cost of full-time management, a digital guidebook can reduce your workload immediately!

Start managing your property smarter with Touch Stay!

15. Property tax

Local property taxes (like Council Tax, if paid by the landlord during void periods, or other municipal taxes) are fully deductible during the period the property is held for rental purposes.

16. Repairs

A repair restores an asset (e.g., fixing a leak) and is a current deduction. Always document the nature of the work, ensuring it does not materially add value to the property or significantly prolong its useful life (which would make it a capital expense).

17. Tenant screening

The cost of verifying potential tenants is an ordinary and necessary deduction. This includes fees for:

- Background checks and credit reports

- Reference checks

- Third-party screening services

💡 Pro tip: Check out our top tips for Airbnb background screening

18. Utilities

Any utility expense that you pay as the landlord to keep the property ready for rent is deductible. This applies to:

- Common area utilities in multi-unit buildings

- Utilities paid during vacant periods or included in short-term stays

19. Security systems and alarm monitoring fees

The ongoing fees for professionally monitored security systems, CCTV, or fire alarms are deductible operating expenses. The initial installation may need to be depreciated, but the monthly monitoring fees are a current deduction.

20. Cleaning and janitorial services

Cleaning fees are fully deductible, particularly for short-term rentals or for long-term rentals between tenants. This also applies to services for common areas in shared dwellings.

💡 Pro tip: Don’t miss a spot with our Airbnb cleaning checklist

21. Legal and professional fees

Costs incurred for legal advice related to your rental business are deductible. This includes fees paid to a solicitor for:

- Drafting or amending leases

- Handling evictions

- Advising on landlord-tenant disputes

22. Accounting and bookkeeping services

The expense of hiring an accountant or bookkeeper to prepare your rental property tax returns or maintain financial records is fully deductible. This investment often pays for itself in time saved and tax savings found.

23. Travel expenses related to property management

If you travel to your property for business purposes (maintenance, meetings, walkthroughs), these expenses can be deducted. This includes the cost of:

- Fuel or mileage

- Tickets for trains or airfare

Keep a detailed log of your travel.

24. Pest control

The costs of routine maintenance or necessary treatment for vermin or insects are deductible. This keeps the property habitable and protects your investment from damage.

25. Supplies and small equipment purchases

This covers smaller, necessary costs for upkeep and operation, such as:

- Light bulbs and replacement door handles

- Cleaning materials and smoke detectors

- Small hand tools used solely for property maintenance

Tired of losing track of your expenses while simultaneously repeating the same information to every new guest?

Cut the confusion, save yourself time and enhance your guest experience with a digital guidebook. Touch Stay is the operational deduction that pays for itself!

The power of preparation

Running a profitable rental business requires organisation. When filing your tax return, you need to confidently present all your rental property deductions.

By using a system that:

- Streamlines your guest communication (like a digital guidebook)

- Keeps your operational costs low

You are setting yourself up for financial success. A highly organised business means less time spent on admin, more time focusing on growth, and a happier accountant. Don’t let these 25 essential landlord tax write-offs pass you by.

Ready to streamline your property operations and make tax time easier?

Take the first step towards smarter management with Touch Stay today.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates