Quick Asnwer (TL;DR)

The BRRRR method is a real estate investing strategy where you buy a distressed property, rehab it to increase value, rent it out, refinance to pull your initial capital back out, and repeat the process.

Instead of saving for new down payments, BRRRR lets you recycle the same capital to scale faster, often acquiring multiple rental properties within a few years. It works best in strong rental markets and for hands-on investors comfortable managing renovations and financing.

Property investment has long been a staple of wealth building, but the traditional 'buy and hold' model has faced significant headwinds lately. Higher interest rates and evolving tax laws mean that simply buying a house and renting it out often isn't enough to achieve rapid growth. This is where the BRRRR method comes in.

BRRRR is a high-growth strategy designed for investors who want to scale their portfolio quickly by recycling the same pot of capital over and over again. In the US market, where average property prices have risen 4-6% annually over the past decade, the BRRRR method allows investors to leverage forced appreciation rather than waiting for natural market growth. Instead of saving for a new deposit every few years, you 'force' equity into a property and pull your initial investment back out to go again.

According to recent real estate investment data, the average rental property investor waits 5-7 years to save for a second property down payment. With the BRRRR method, investors can potentially acquire 3-4 properties in the same timeframe by recycling their initial capital. This accelerated approach has gained significant traction among US property investors seeking portfolio growth despite higher interest rates and stricter lending criteria.

In this guide, we'll break down exactly how this cycle works and how you can use it to build a property empire:

- What is the BRRRR method?

- Step-by-step breakdown of BRRRR strategy

- How BRRRR works financially

- Pros & benefits of BRRRR

- Risks & challenges

- When the BRRRR method makes sense

- Common mistakes in BRRRR strategy

- BRRRR strategy examples

- Frequently asked questions

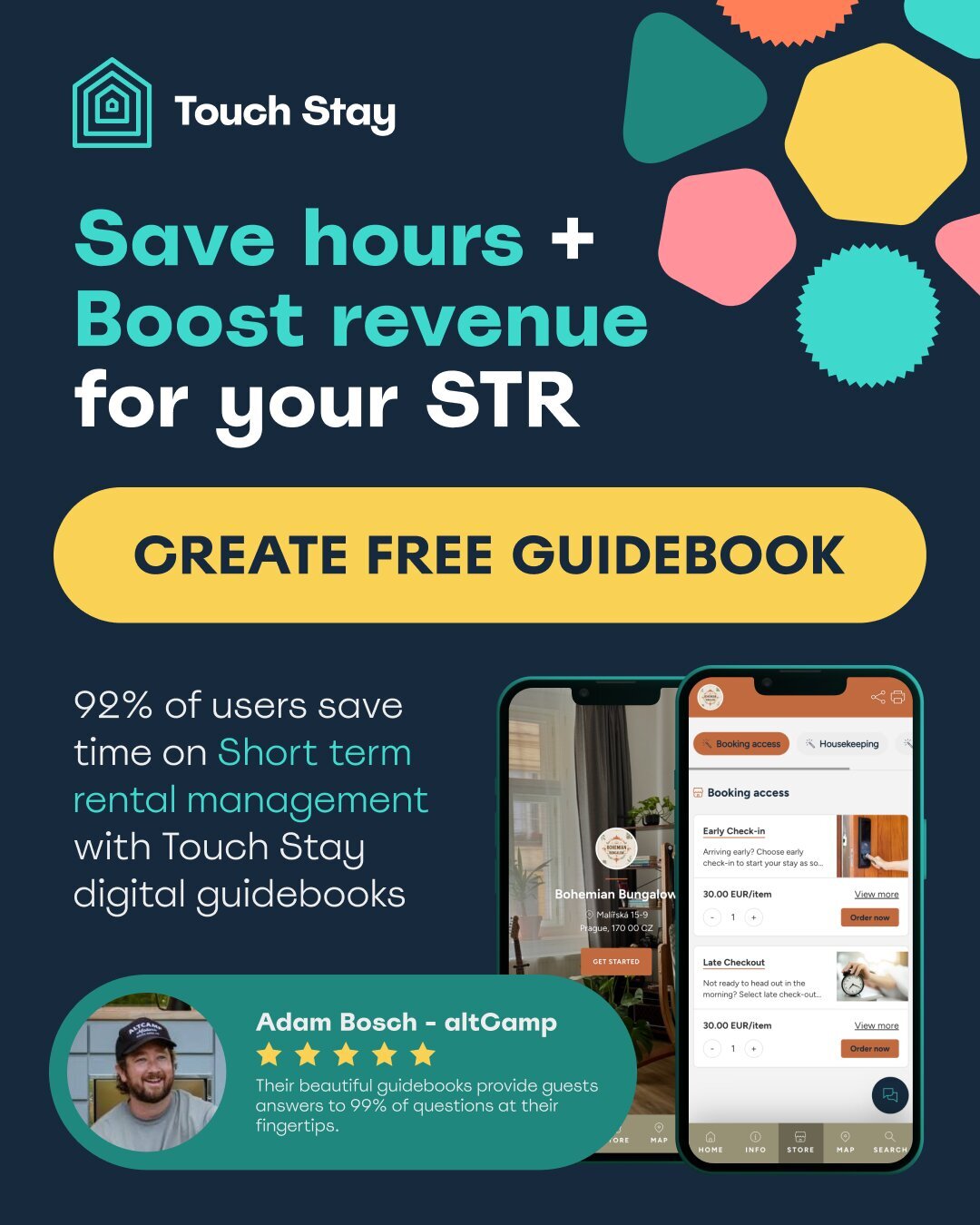

Want a shortcut to more efficient property management?

Our AI guidebook generator creates professional property guides in under 60 seconds.

What is the BRRRR method?

The BRRRR method is an acronym that stands for Buy, Rehab, Rent, Refinance, Repeat. It is a framework for buying properties that need work, increasing their value through renovation, and then refinancing them based on their new, higher value to recoup your initial capital.

BRRRR Method Quick Summary:

- Buy distressed property below market value (BMV)

- Rehab with strategic renovations to force equity

- Rent to reliable tenants for stable cash flow

- Refinance at 75% LTV to extract initial capital

- Repeat the cycle to scale your portfolio

Time per cycle: 6-12 months | Typical capital needed: $50,000-$100,000 | Best for: Active investors seeking rapid portfolio growth

Definition

At its core, BRRRR is a 'distressed property' strategy. You aren't looking for a turnkey home that is ready for a family to move into. You are looking for the 'ugly' house on a nice street – the one with the outdated kitchen, foundation issues, or overgrown yard – that you can buy below market value.

The BRRRR method has gained significant traction in US markets, particularly in the Midwest and Southeast, where property prices remain accessible while rental demand stays strong. Markets like Indianapolis, Memphis, Kansas City, and Phoenix offer ideal conditions: distressed properties available below $150,000, renovation costs under $50,000, and strong rental yields of 8-12%.

BRRRR vs. house flipping

While both involve renovating properties, the end goal is entirely different. A house flipper sells the property immediately to realise a one-time profit. A BRRRR investor keeps the property, lets it out to tenants and uses the rental income to pay the mortgage while benefitting from long-term capital growth.

|

Factor |

BRRRR Method |

House Flipping |

|

Timeline |

6-12 months |

3-6 months |

|

Exit strategy |

Refinance & hold |

Sell immediately |

|

Income type |

Passive rental income |

One-time profit |

|

Tax implications |

Depreciation benefits |

Capital Gains Tax |

|

Long-term wealth |

High (equity + cash flow) |

Medium (cash only) |

|

Capital recycling |

Yes |

No |

Building wealth by recycling capital

The magic of BRRRR is the ability to use the same $75,000 (or whatever your starting capital is) multiple times. In a traditional purchase, your down payment is 'stuck' in the house until you sell it. With BRRRR, you aim to pull that down payment back out via a refinance, meaning you can buy your second, third and fourth properties using the exact same money.

Step-by-step breakdown of BRRRR strategy

To succeed with this method, you have to follow the cycle in a very specific order. One mistake in the early stages can jeopardise the refinance at the end.

1. Buy (finding undervalued property)

The profit is made when you buy. You need to find a property that is priced significantly below what it could be worth if it were in good condition. Look for motivated sellers, foreclosures, estate sales, or properties with issues that prevent conventional financing.

Use county assessor records, Zillow, Redfin, and Realtor.com to identify distressed properties and analyze market values.

2. Rehab (renovations that increase value)

This stage is about 'forced appreciation'. You aren't just decorating; you are adding value. This might involve adding an extra bedroom, finishing a basement, or installing a modern kitchen and bathroom. The goal is to spend $1 on renovations to see a $2 or $3 increase in property value.

Focus on improvements that maximize ARV (after-repair value): kitchens, bathrooms, flooring, curb appeal, and system updates (HVAC, electrical, plumbing).

3. Rent (securing reliable tenants)

Banks generally won't refinance a property on a rental property mortgage unless it is tenanted or ready to be rented. Securing a reliable tenant at market rent proves to the lender that the property can cover its own mortgage costs.

Always comply with Fair Housing Act requirements and properly screen tenants using background checks, credit reports, and rental history verification.

💡 Pro ‘self-management’ tip: As your portfolio grows through BRRRR, managing multiple properties becomes a full-time job. Using Touch Stay digital guidebooks can drastically reduce communication time and improve tenant experience. See Go Local VR's results here.

Ready to scale your property management?

4. Refinance (cash-out refinance for capital recovery)

Once the property is refurbished and tenanted, you go to a lender for a new mortgage. If the property was originally worth $150,000 but is now worth $240,000 thanks to your hard work, a 75% Loan-to-Value (LTV) mortgage would give you $180,000. This should be enough to pay off your initial purchase loan and, ideally, give you back your original down payment.

Most conventional lenders follow Fannie Mae and Freddie Mac guidelines for investment property refinancing, typically capping cash-out refinances at 75% LTV.

5. Repeat (reinvesting captured capital)

Now that you have your original capital back in your bank account – and you still own a cash-flowing asset – you start the process again with the next property.

How BRRRR works financially

The financials of BRRRR are more complex than a standard purchase. You need to understand your ‘velocity of money’.

After-repair value (ARV) calculation

The ARV is the most critical number in your spreadsheet. This is what the property will be worth once the renovation is complete. You calculate this by analyzing comparable sales (comps) of similar properties in excellent condition within a half-mile radius.

Use the MLS (Multiple Listing Service), Zillow sold prices, Redfin data center, and county property records to find recent sold prices—not listing prices.

How to calculate ARV: Look at at least three comparable properties that have sold in the last 6 months within a very close proximity that are in the condition you intend to achieve. Factor in square footage, bedroom/bathroom count, lot size, and neighborhood characteristics.

Refinancing scenarios and options

Most US lenders require a 'seasoning period' of 6-12 months before they allow cash-out refinancing based on the new appraised value. During the Buy and Rehab phases, investors typically use hard money loans or private money lenders—short-term, higher-interest financing designed specifically for fix-and-flip and BRRRR projects.

US Financing Options for BRRRR:

- Hard money loans: 10-15% interest, 6-12 month terms, 65-75% LTV

- Private money lenders: Flexible terms, relationship-based

- DSCR loans (Debt Service Coverage Ratio): Qualify based on property cash flow, not personal income

- Portfolio lenders: More flexible than Fannie/Freddie, allow faster refinancing

- Conventional cash-out refinance: 75% LTV limit for investment properties

Understanding mortgage lending requirements is essential before starting your first BRRRR project.

Cash flow vs. equity extraction

You must strike a balance. Pulling out too much cash via a high LTV refinance can lead to high monthly payments, which might eat into your cash flow. Most conventional lenders limit cash-out refinances on investment properties to 75% LTV, though some portfolio lenders may go higher.

Ensure that even after the refinance, the rent comfortably covers the mortgage, insurance, property taxes, and maintenance – typically aim for a 1.2-1.3x DSCR (Debt Service Coverage Ratio).

Pros & benefits of BRRRR

Why go through the stress of a renovation instead of just buying a turnkey rental?

Portfolio growth without new capital

This is the primary driver. If you can successfully 'money-out' (pull all your initial investment back), your return on investment (ROI) becomes theoretically infinite because you have none of your own money left in the deal.

Potential passive rental income

Once the 'Repeat' stage is reached, you have a property that pays for itself. Over time, as rents rise and mortgages stay relatively stable, this becomes a significant source of passive income.

For those considering alternatives, compare the BRRRR method with Airbnb vs. long-term renting strategies to determine which exit strategy maximizes your returns.

Forced appreciation via renovation

You aren't waiting for the market to go up by 3-4% a year. You are creating your own equity by turning a run-down house into a desirable home. This provides a 'buffer' if the wider property market stays flat or declines.

Scalability for long-term growth

BRRRR allows you to grow as fast as you can manage the renovations. For those looking to leave a 9-to-5 job, this is often the fastest route to replacing a salary with passive rental income.

Risks & challenges

It isn't all plain sailing. BRRRR requires a high tolerance for risk and excellent project management.

High upfront capital requirement

You usually need cash or a hard money loan to buy the property and pay for the renovation work. Conventional mortgages typically won't finance properties that are uninhabitable or don't meet Fannie Mae/Freddie Mac minimum property standards.

Renovation costs exceeding budget

'Scope creep' is the enemy of the BRRRR investor. Unforeseen structural issues (foundation problems, mold, electrical upgrades) or rising material costs can quickly eat into your profit margins, leaving you with less equity to pull out at the end.

Always include a 15-20% contingency in your budget for the 'unknown unknowns'. The National Association of Home Builders provides renovation cost guidelines.

Insufficient equity for refinancing

If the appraiser doesn't agree with your ARV, they might 'down-value' the property. If you expected it to be worth $240,000 but they value it at $210,000, you won't be able to pull all your money out, and your capital becomes stuck.

Market risks (rates, vacancies)

If interest rates spike during your Rehab phase, your exit mortgage might be much more expensive than you planned. Monitor the Federal Reserve's monetary policy and Census Bureau rental market data to anticipate market shifts.

Likewise, if the local rental market is flooded with similar properties, you might face a vacancy period where you are paying the mortgage out of your own pocket.

When the BRRRR method makes sense

This strategy isn't for everyone. It requires a specific set of circumstances to work effectively.

- Strong rental demand markets: You need to be in an area where people actually want to live. University towns or growing commuter hubs are ideal.

- Investors ready for active management: BRRRR is not ‘passive’ in the beginning. You are a project manager, a negotiator and a landlord.

- Focus on long-term portfolio growth: If you need a quick cash injection, flipping is better. BRRRR is for people building a multi-year wealth strategy.

Common mistakes in BRRRR strategy

Learning from those who have failed is just as important as copying those who have succeeded.

Overpaying for the property

You cannot 'rehab' your way out of a bad purchase price. If you pay too much at the start, no amount of high-end finishes and new appliances will save your margins.

The 70% rule is a common guideline: pay no more than 70% of ARV minus renovation costs. For example, if ARV is $240,000 and repairs cost $40,000, maximum purchase price should be $128,000 (70% × $240,000 - $40,000).

Misestimating ARV and budget

Investors often suffer from 'optimism bias'. They assume the highest possible sale price and the lowest possible building costs. Always get multiple contractor bids and include a 15-20% contingency in your budget.

Not screening tenants properly

In the rush to get the property tenanted for the refinance, some investors take the first person who shows up. A bad tenant who doesn't pay rent can stop your refinance dead in its tracks.

Use comprehensive tenant screening including credit checks, background checks, employment verification, and previous landlord references. Ensure compliance with Fair Housing regulations.

Starting without enough cash reserves

You need a 'rainy day' fund. If the refinance takes three months longer than expected, can you still afford the hard money loan interest? Aim to have 6-12 months of carrying costs in reserve.

BRRRR strategy examples

Single-family property scenario

An investor buys a 3-bedroom, 2-bath single-family home for $150,000 in a growing Midwest market. They invest $30,000 in a full kitchen and bathroom remodel, new flooring, fresh paint, and updated systems. The new ARV is $240,000.

A 75% LTV cash-out refinance provides $180,000 ($240,000 × 0.75). After paying off the initial $150,000 purchase loan, the investor has $30,000 remaining, exactly recovering their renovation costs. They now own a cash-flowing rental property with zero money left in the deal.

Monthly numbers:

- Market rent: $1,800

- Mortgage payment (75% LTV): $1,100

- Property taxes: $250

- Insurance: $100

- Maintenance reserve: $150

- Net cash flow: $200/month

Multi-unit BRRRR deal

Buying a large house and converting it into a duplex or triplex. The costs are higher and zoning approvals are a hurdle, but the 'forced appreciation' is often much larger, allowing for significant cash extraction. Many investors target 2-4 unit properties that qualify for FHA or conventional financing while offering superior cash flow.

Frequently asked questions

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It's a real estate investment strategy focused on acquiring distressed properties, renovating them to increase value, renting them out, refinancing to extract capital, and repeating the process to build a portfolio.

Typically, a BRRRR cycle takes 6 to 12 months. This allows for 3-4 months of renovation and a 6-12 month 'seasoning' period required by most lenders before approving cash-out refinancing based on the new appraised value.

It depends on your goal. Flipping builds 'active' cash (lump sum profits), while BRRRR builds 'passive' wealth (equity and monthly rental income). BRRRR provides long-term cash flow and allows you to benefit from property appreciation, while flipping provides immediate capital but no ongoing income.

Look at at least three comparable properties that have sold in the last 6 months within close proximity that are in the condition you intend to achieve. Use HM Land Registry Price Paid Data, Zillow sold prices, and Redfin property data for the most accurate comps. Factor in square footage, bed/bath count, lot size, and condition.

The 75% rule in BRRRR means most lenders will refinance at 75% Loan-to-Value (LTV) of your property's after-repair value (ARV). For example, if your ARV is $240,000, you can typically borrow $180,000 (75%), which should cover your initial purchase price and renovation costs if you've bought well below market value.

To start BRRRR in the US, you typically need $50,000-$100,000 in initial capital. This covers a down payment for a distressed property ($100,000-$150,000 purchase price), renovation costs ($30,000-$50,000), and holding costs during the 6-12 month project timeline. Alternatively, investors can use hard money loans to reduce upfront capital requirements.

Ned

Ned has clocked up over 11 years in digital marketing and comms, with a strong focus on creating engaging content for a range of brands and agencies. When he’s not writing, he can be found digging for records, peering through his telescope at the night sky, or onboard his local lifeboat where he volunteers as a crewmember.

Be the first to know!

Join our newsletter for early access to:

- ✅ Free guides

- ✅ Pro tips & tricks

- ✅ Time saving tutorials

- ✅ Latest blog posts

- ✅ Checklists & templates

.webp?width=50)

%20and%20how%20to%20calculate%20it.webp?width=50)